Spread betting allows traders and investors in the United Kingdom to wager on the direction of a financial asset without actually owning it. You will profit if you bet that a financial market will rise and the price ends up higher than the price at which you made the bet. Otherwise, you will lose money on that bet. Spread betting allows UK investors to bet on an asset’s value falling. If the market value falls below where you shorted, you will profit on this trade, also known as short selling. You will lose money if the price is higher than the price at which you shorted. Traders that engage in spread betting wager in GBP per pip, point, or tick, depending on the market on which they are betting.

Spread betting allows you to use leverage when placing trades because it is a derivative product (you don’t own the actual asset; you simply bet on its price). Leverage is the ability to borrow money from brokers/spread betting providers in order to put larger bets with less capital. When compared to trading without leverage, this allows you to optimize profits on your capital because the amount necessary to open trades is reduced. However, while potential returns may be greater when trading with leverage, trading with leverage also raises the dangers involved with trading and can result in larger losses.

Broker Review Contents

Is spread betting capital gains tax free?

Spread betting can be capital-gains tax free in some cases, but it’s better to consult with a tax specialist regarding this.

How does spread betting work?

To understand better how spread betting works, we will show three example trades – one on a forex pair, one on the FTSE100 Index and one on Aston Martin shares.

FX Trade examples:

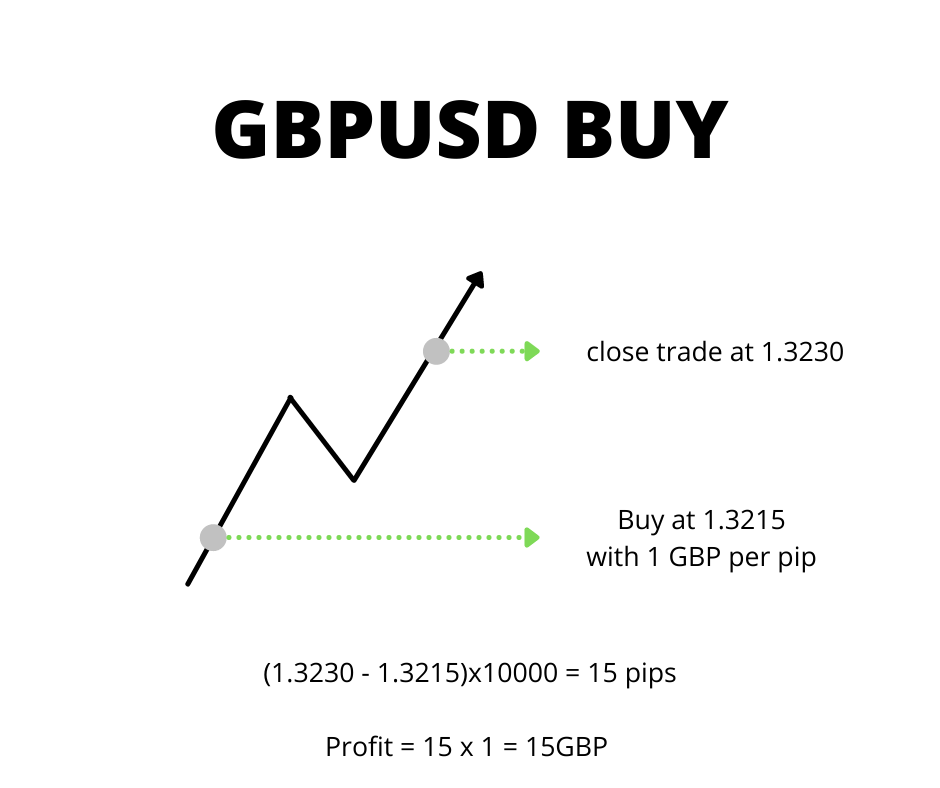

As previously mentioned, FX spread betting works in terms of GBP per pip. This means that if I were to use a trade size of 1, I would earn or lose 1GBP for every pip move in the price. A pip is normally the 4th decimal of the quoted FX pair. The exception for this rule are JPY pairs where the pip is the 2nd decimal.

If I were to buy GBPUSD at 1.3215 with trade size of 1, thus betting that the pound will appreciate against the dollar, and in a few days the GBPUSD rate went up to 1.3230, this means that the price moved up by 15pips, your profit would be 15GBP (minus overnight fees).

If you were to sell USDJPY with a trade size of 15, at 113.550 and a few days later the USDJPY rate fell to 113.350, the price would have moved by 20 pips thus giving you a profit of 300GBP (minus overnight fees).

FTSE 100 example:

When you spreadbet on indices, you do so in terms of GBP per point. A point in trading is the last digit before the decimal. In the case of the FTSE100, if you were trading at a price of 7312.89, the ‘2’ is the point. So following this, if you were to sell short the FTSE100 at 7312.89 with a size of 10, betting that its price would go down, but unfortunately in a few days the price went up to 7330.89 – you would lose 18*10 = 180 GBP (excluding overnight costs). The price went 18 points against you.

Aston Martin shares example:

Spread betting involves staking a certain amount of money per point of change in the underlying asset’s price. For instance, if you believed the price of Aston Martin’’s stock would go up, you could go long at £30 per point of change. If you bought at 1353 and the price went up to 1363, you would profit £300, ignoring overnight holding charges. If it fell by ten points to 1343, you would lose £300.

As you can see the basics aren’t that complicated, because spread betting works in terms of GBP per pip/point.

Ready to start trading? Check some of the top spread betting brokers.

You can also use our spread betting broker comparison tool.

For the differences between spread betting and CFDs you can check this article.