Spread betting is one of the most popular ways for traders and investors in the United Kingdom to speculate on the price of an asset without actually owning it. Traders can do spread betting on shares from UK, US and many other international stock markets. Make sure to pick a broker which offers the shares which you want to spread bet on. Financial spread betting includes stocks, indices, commodities etc. Forex spread betting is used to bet on the exchange rate between two currencies going up or down.

Spread betting on shares allows traders to make bets on the shares going up and going down (shorting). They have the opportunity to speculate and profit not only from the price of a stock going up, but also when it goes down. Not only that but holders of stock portfolios can use spread betting to hedge their downside risk.

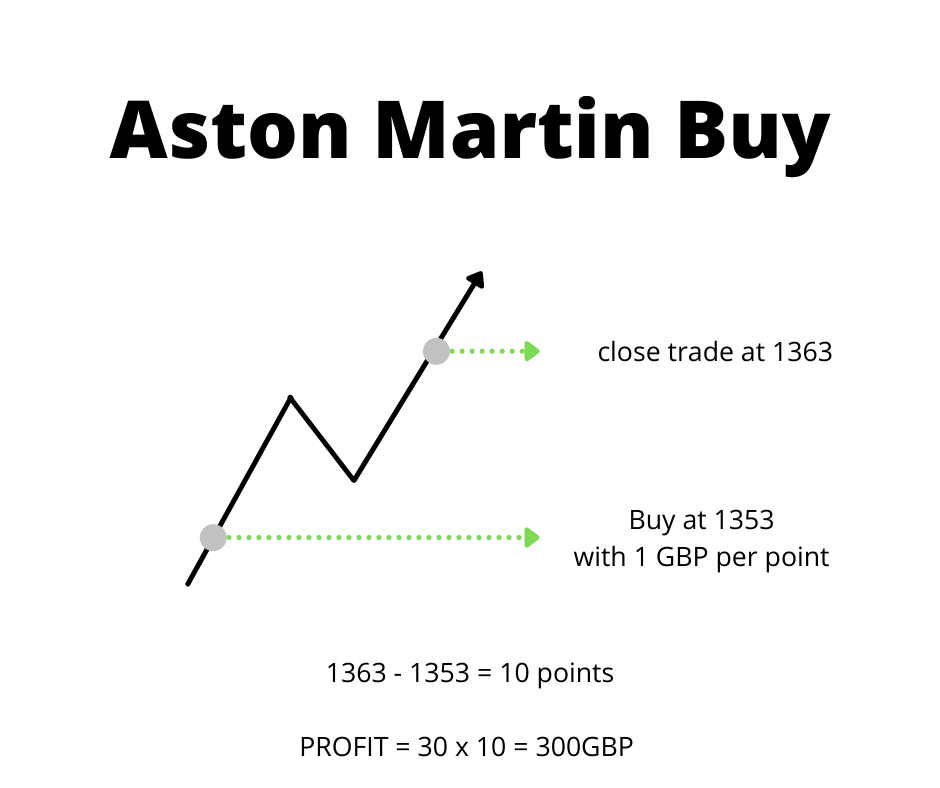

Aston Martin shares spread betting example:

Spread betting on shares involves staking a certain amount of money per point of change in the underlying asset’s price. You do some research on fundamental and technical indicators and this leads you to believe that the price of Aston Martin’’s shares would go up. You decide that you could go long at £30 per point of change. If you bought at 1353 and the price went up to 1363, you would profit £300, ignoring overnight holding charges. If it fell by ten points to 1343, you would lose £300. The graphs below illustrate how spread betting on shares works based on the examples.

Ready to start trading? Check some of the top spread betting brokers.

You can also use our spread betting broker comparison tool.

Check the main differences between Spread Betting and CFD Trading here.

Haven’t traded before? Check our best spread betting platforms for beginners article.