Spread betting is one of the preferred methods for UK based traders and investors to speculate on the price of an asset without owning it. This includes spread betting on indices such as the FTSE100, Dow Jones, DAX and SP500. Financial spread betting includes stocks, indices, commodities etc. Forex spread betting is used to bet on the exchange rate between two currencies going up or down. When you spread bet you can profit from both the price going up or going down (shorting).

Spread Betting on indices: FTSE 100 example

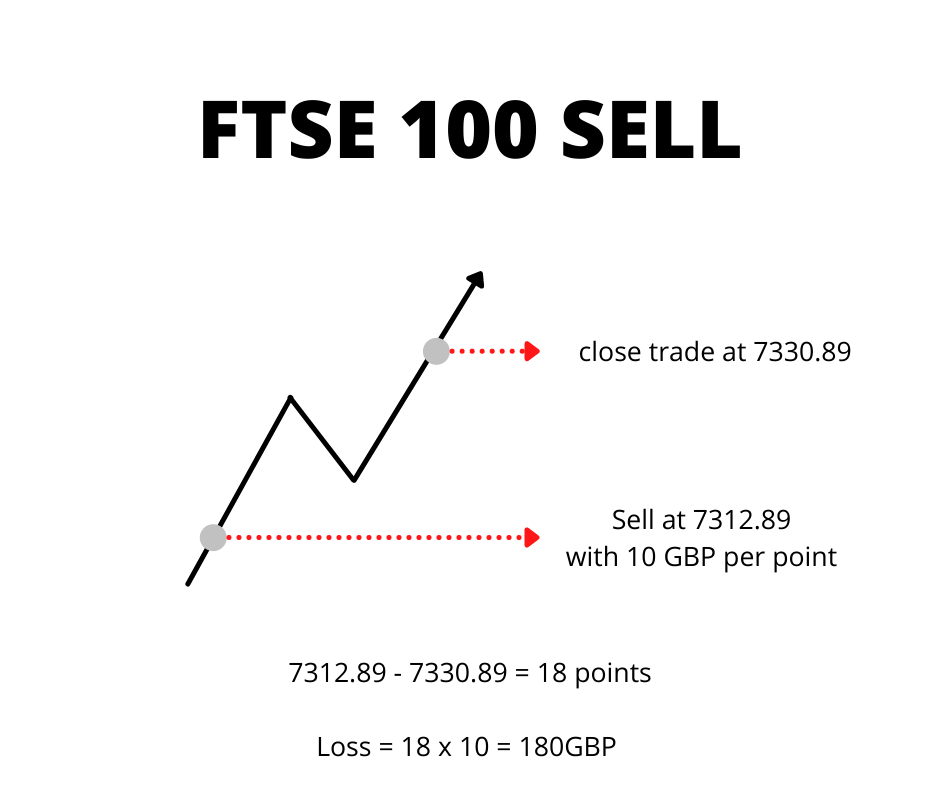

When you spread bet on an index, you do so in terms of GBP per point. A point in trading is the last digit before the decimal. In the case of the FTSE100, if you were trading at a price of 7312.89, the ‘2’ is the point. So following this, if you were to sell short the FTSE100 at 7312.89 with a size of 10, betting that its price would go down, but unfortunately in a few days the price went up to 7330.89 – you would lose 18*10 = 180 GBP (excluding overnight costs). The price went 18 points against you. The graphs below illustrate how spread betting on indices works based on the example.

As you can see the basics of spread betting on indices aren’t that complicated, because spread betting works in terms of GBP per pip/point.

Spread betting on shares works in a similar way to index spread betting, but if you want to find out more check our article on spread betting on shares.

Ready to start trading? Check some of the top spread betting brokers.

You can also use our spread betting broker comparison tool.

Check the main differences between Spread Betting and CFD Trading here.

Haven’t traded before? Check our best spread betting platforms for beginners article.