Financial spread betting is betting on whether the price of a financial product (index, stock, bond, or commodity) will rise or fall without actually owning the product. It effectively indicates that you’re wagering solely on the market’s price. As a result, you’re agreeing with the Spread betting provider that if you lose money on a bet, money from your account will be sent to them, and vice versa if you win money on a bet, money from their account will be transferred to your account. The bets in this sort of spread betting are placed in GBP per point/tick.

Financial spread betting allows you to use leverage when placing trades because it is a derivative product (you don’t own the underlying asset; you simply bet on its price). Leverage is the ability to borrow money from brokers/spread betting providers in order to put larger bets with less cash. Trading with leverage may help you to optimise profits on your capital because of the lower amount necessary to open trades. However, while potential returns may be greater when trading with leverage, trading with leverage also raises the dangers involved with trading and can result in larger losses.

Spread betting can be capital-gains tax free in some cases, but it’s better to consult with a tax specialist regarding this. For more information on the potential benefits of trading via spread betting rather than cfds you can check this article.

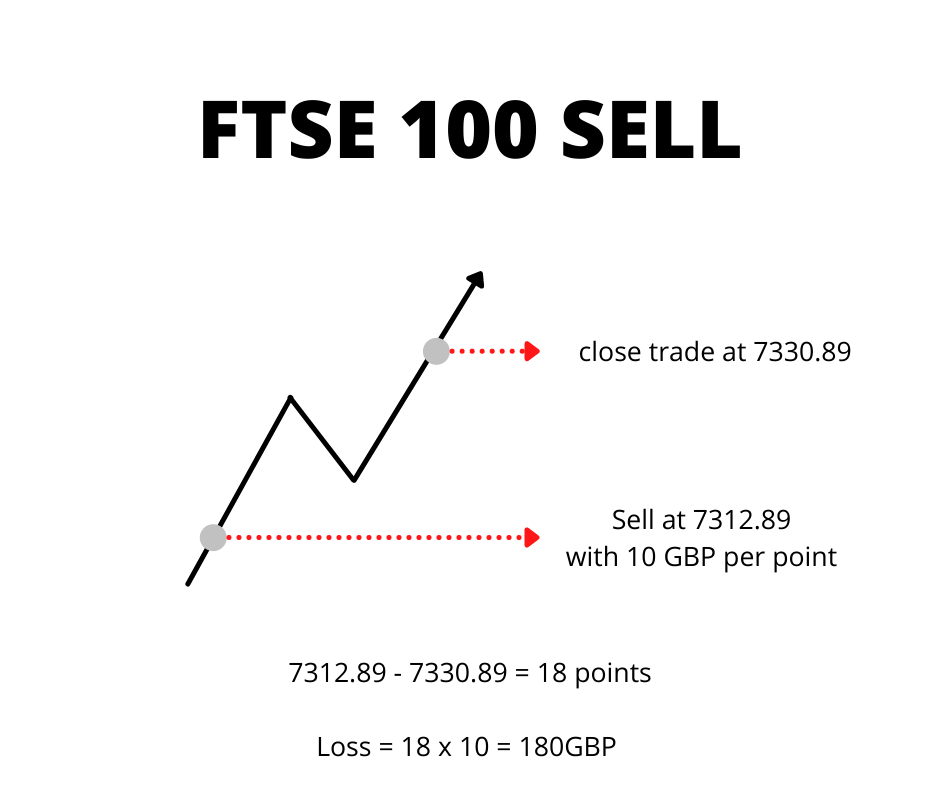

Financial Spread Betting FTSE 100 example:

When you do financial spread betting on indices, you do so in terms of GBP per point. A point in trading is the last digit before the decimal. In the case of the FTSE100, if you were trading at a price of 7312.89, the ‘2’ is the point. So following this, if you were to sell short the FTSE100 at 7312.89 with a size of 10, betting that its price would go down, but unfortunately in a few days the price went up to 7330.89 – you would lose 18*10 = 180 GBP (excluding overnight costs). The price went 18 points against you.

As you can see the basics of financial spread betting aren’t that complicated, because it works in terms of GBP per pip/point.

Interested in FX spread betting? Check our article here.

Ready to start trading? Check some of the top spread betting brokers.

You can also use our spread betting broker comparison tool.