CFD trading is one of the preferred methods for traders and investors to speculate on the price of an asset without owning it. This includes index CFDs trading for indices such as the FTSE100, Dow Jones, DAX and SP500.

Index CFDs are one of the most common ways retail traders get exposure to stock markets without buying individual shares. Instead of purchasing stocks, you trade a contract that tracks the price movement of a stock index such as the S&P 500, NASDAQ 100, FTSE 100, DAX 40, or Nikkei 225. In 2026, index CFDs remain popular because they are simple to understand, highly liquid, and useful for both short term trading and hedging.

This guide explains exactly how index CFDs work, how pricing is calculated, what costs apply, how leverage changes risk, and what traders should check before placing their first index CFD trade.

Broker Review Contents

What is an index CFD

An index CFD is a Contract for Difference that mirrors the price of a stock index. When you trade an index CFD, you do not own the underlying stocks. You are simply speculating on whether the index price will rise or fall.

If you buy an index CFD, you profit when the index rises.

If you sell an index CFD, you profit when the index falls.

The broker pays or charges the difference between your entry price and exit price, adjusted for costs like spread and overnight financing.

What is a stock index

A stock index is a benchmark that measures the performance of a group of stocks. It can represent a country, a sector, or a theme. Examples include:

S&P 500 which tracks large US companies

NASDAQ 100 which focuses more on tech heavy US firms

FTSE 100 which tracks large UK companies

DAX 40 which tracks major German companies

Nikkei 225 which tracks leading Japanese companies

Indexes move based on how the underlying stocks move, plus market sentiment, interest rate expectations, and global economic news.

How index CFD pricing works

Index CFD pricing is derived from the underlying market. Depending on the broker and the specific instrument, pricing can be based on:

The cash index price (spot)

The futures price (often used for after hours quotes)

A synthetic price that closely tracks the underlying using liquidity sources

Bid and ask price

You always see two prices:

Bid is the price you can sell at

Ask is the price you can buy at

The difference is the spread, which is one of the main trading costs.

Example of the spread

If US500 is quoted as:

Bid 5000.0

Ask 5000.8

The spread is 0.8 points. If you buy, you start slightly negative because you entered at the ask but could only exit immediately at the bid.

How profit and loss is calculated

Profit and loss depends on:

The price move in points

Your contract size

How many contracts you trade

Example

You buy 1 contract of an index CFD where 1 point equals $1.

Entry 5000

Exit 5020

Move 20 points

Profit = 20 x $1 = $20 (minus spread and any financing)

If instead the index drops to 4980, the loss would be:

20 points x $1 = $20 (plus costs)

Different brokers use different point values, so always confirm the “contract specification” before trading.

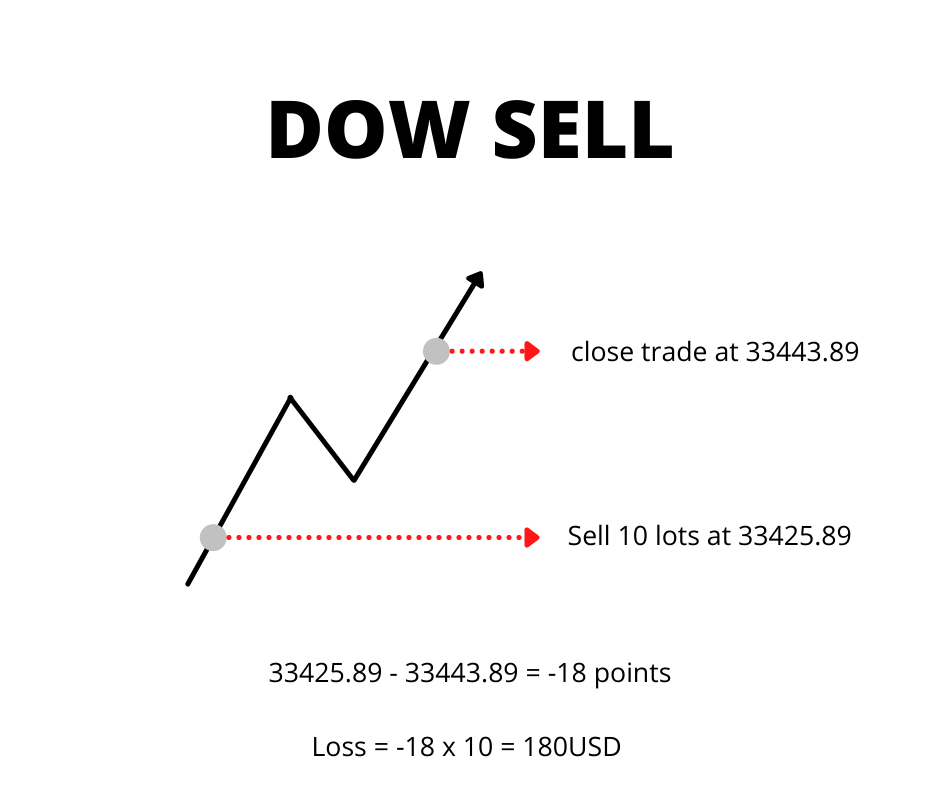

Dow Jones Index CFDs trade example:

When you trade index CFDs, you do so in terms of lots. Each index has a particular contract size per lot, and it’s important for you to know what that size is in order to understand exactly how much you are buying or selling, and to understand the risk involved with your trade. Let’s say that you are trading the Dow Jones (many CFD brokers have it as US30) with a broker where the contract size for 1 lot is 1.

A point in trading is the last digit before the decimal. In the case of the Dow index, if you were trading at a price of 33425.89, the ‘5’ is the point. So following this, if you were to sell short the Dow index cfds at 33425.89 with a size of 10, betting that its price would go down, but unfortunately in a few days the price went up to 33443.89 – you would lose 18*10 = 180 USD (excluding overnight costs). The price went 18 points against you.

Interested in FX trading? Check our article here.

Trading stock CFDs works in a similar way to index CFD trading, but if you want to find out more check our article on how equity CFDs work.

Ready to start trading? Find your cfd broker with our cfd broker comparison tool.

Also please check out our broker finder tool on the homepage. It’s the easiest way to find the broker which best matches your trading needs.

Leverage and margin explained

Index CFDs are leveraged products. That means you only deposit a portion of the position value as margin.

Margin example

If you open a $10,000 index CFD position and the margin requirement is 5 percent, you need $500 as initial margin.

Leverage increases potential returns, but it also increases losses. A small index move can have a large effect on your account if your position is big.

Why margin calls happen

If the market moves against you and your account equity falls below a maintenance threshold, the broker may:

Send a margin call

Reduce your available margin

Automatically close positions (stop out)

This is why position sizing matters more than leverage alone.

Key costs when trading index CFDs

Most traders focus on spreads but there are several important cost categories.

Spread

This is the difference between bid and ask. It is paid every time you enter a trade.

Overnight financing

If you hold an index CFD overnight, you usually pay or receive a financing adjustment. For most long positions, it is a cost. For short positions, it can still be a cost depending on rates and broker markup.

Financing is one reason why index CFDs are often better for shorter term strategies unless the costs are managed carefully.

Commission

Many brokers charge no commission on index CFDs because they earn from the spread. Some brokers may add a commission on certain account types, especially if they provide tighter spreads.

Guaranteed stop loss premium

Some brokers offer guaranteed stop losses on indices. This can protect you from gapping risk, but usually comes with an extra fee.

Trading hours and why after hours pricing looks different

Stock indexes have primary cash market hours based on the exchange. However, many brokers offer near 24 hour CFD pricing by using futures markets and liquidity sources.

That means:

Spreads can widen outside main trading hours

Volatility can spike around US market open and close

Pricing can react to global events even when the cash market is closed

Traders should avoid judging a broker only by “normal hours” spreads. The true test is how pricing behaves during high impact news and outside peak liquidity.

Why traders use index CFDs

Broad market exposure

Instead of picking individual stocks, you trade the whole market segment. This reduces single stock risk.

Short selling is easy

Selling an index CFD is usually as simple as clicking sell. There is no borrowing process like traditional shorting.

Hedging

Traders and investors use index CFDs to hedge portfolios. For example, if you hold long term stocks and fear a short term pullback, you can short an index CFD as temporary protection.

Tactical trading

Indexes are popular for day trading and swing trading because they respond strongly to macro news, central bank decisions, inflation data, and risk sentiment.

Risks of index CFD trading

Index CFDs are high risk due to leverage and fast moves.

Leverage risk

A small market movement can wipe out a large portion of your margin if the position size is too big.

Gap risk

Indexes can gap after major news. If the market jumps beyond your stop loss level, you can get filled worse than expected.

Overnight financing drag

Holding CFDs for long periods can be expensive due to financing costs, especially on larger positions.

Broker and execution risk

Execution quality matters. During volatility, slippage and spread widening can be severe. Traders should test execution in a demo and review contract terms.

Index CFDs vs index ETFs vs index futures

Index CFDs

Flexible sizing, easy shorting, margin based, financing costs apply

Index ETFs

You own a fund that tracks the index, usually best for long term investing, no leverage unless you use margin accounts, lower overnight cost structure

Index futures

Often used by professionals, standardized contracts, can be more cost efficient for active trading, but require more knowledge and larger contract sizing

Practical examples of index CFD strategies

Trend following

You trade in the direction of the prevailing trend using moving averages and structure highs and lows.

News trading

Index CFDs can react strongly to CPI, jobs reports, central bank speeches, and geopolitical events. Risk controls are essential because spreads can widen quickly.

Mean reversion

Some traders look for overextended moves and trade toward a moving average or a key support zone.

Hedging a portfolio

Shorting an index CFD for a short period can reduce drawdowns during market stress, but it must be sized correctly to avoid over hedging.

What to check before choosing an index CFD broker

A broker can drastically affect your real results. Before opening an account, check:

Regulation and entity protections

Index list and available markets

Average spreads during normal and volatile periods

Overnight financing rates and how they are calculated

Stop out levels and margin policy

Execution quality and slippage during fast markets

Platform reliability on web and mobile

Order types including trailing and guaranteed stops

Deposit and withdrawal reliability

Risk management checklist for index CFDs

Use position sizing based on account risk not leverage max

Always set a stop loss before entering

Avoid holding large leveraged positions through major news

Track overnight financing if you hold positions longer than a day

Do not average down without a plan

Use demo testing to understand spread behavior

Index CFDs are a flexible way to trade global stock markets with the ability to go long or short and use leverage. They are popular because indexes are liquid, widely followed, and react clearly to macroeconomic drivers. The same features that make index CFDs attractive also make them risky. Leverage, financing costs, and execution conditions can turn a small mistake into a large loss.

If you treat index CFDs as a risk-managed product, keep position sizing conservative, and understand all costs, they can be a useful tool for both short term trading and hedging in 2026.

FAQs

1. What is an index CFD?

An index CFD is a contract that allows traders to speculate on the price movement of a stock index without owning the underlying shares.

2. Do index CFDs pay dividends?

Index CFDs do not pay dividends directly, but brokers may apply dividend adjustments to open positions when underlying index stocks pay dividends.

3. Can I trade index CFDs outside stock market hours?

Yes, many brokers offer extended or near 24-hour trading on index CFDs using futures pricing, though spreads may widen outside main market hours.

4. Are index CFDs suitable for beginners?

Index CFDs can be suitable for beginners if traded with low leverage, proper risk management, and a clear understanding of costs and volatility.

5. What are the main costs of trading index CFDs?

The main costs include the spread, overnight financing charges, and any additional fees such as commissions or guaranteed stop premiums, depending on the broker.