CFD trading is one of the preferred methods for traders and investors to speculate on the price of an asset without owning it. This includes index CFDs trading for indices such as the FTSE100, Dow Jones, DAX and SP500.

Index CFDs are an instrument which can be used for short to mid-term speculation by traders. They can also be used by investors who have a stock portfolio to hedge short to mid-term risk. They aren’t attractive for long term traders or investors because of the overnight costs associated with CFD trading.

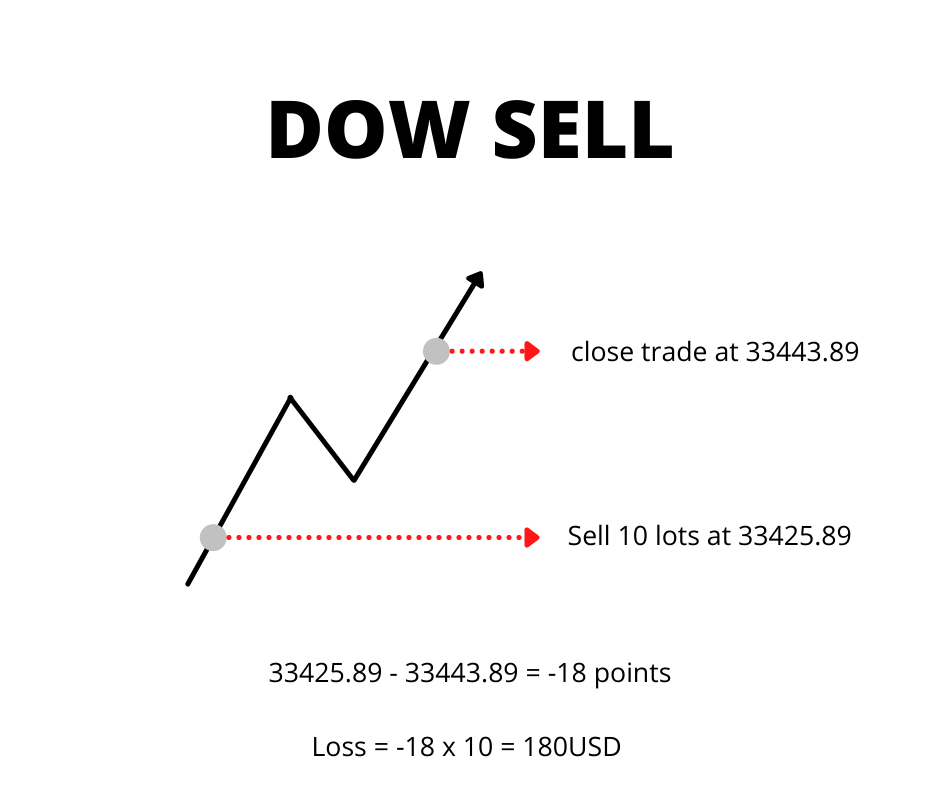

Dow Jones Index CFDs trade example:

When you trade index CFDs, you do so in terms of lots. Each index has a particular contract size per lot, and it’s important for you to know what that size is in order to understand exactly how much you are buying or selling, and to understand the risk involved with your trade. Let’s say that you are trading the Dow Jones (many CFD brokers have it as US30) with a broker where the contract size for 1 lot is 1.

A point in trading is the last digit before the decimal. In the case of the Dow index, if you were trading at a price of 33425.89, the ‘5’ is the point. So following this, if you were to sell short the Dow index cfds at 33425.89 with a size of 10, betting that its price would go down, but unfortunately in a few days the price went up to 33443.89 – you would lose 18*10 = 180 USD (excluding overnight costs). The price went 18 points against you.

Interested in FX trading? Check our article here.

Trading stock CFDs works in a similar way to index CFD trading, but if you want to find out more check our article on how equity CFDs work.

Ready to start trading? Find your cfd broker with our cfd broker comparison tool.

Also please check out our broker finder tool on the homepage. It’s the easiest way to find the broker which best matches your trading needs.