Trading Stock CFDs is a popular way for traders to speculate on the price of an asset without owning it. US, UK and many other shares from international markets are included. Financial CFD trading includes stocks, indices, commodities etc. You can use Forex trading to bet on the exchange rate between two currencies going up or down.

Trading equity CFDs allows traders to make bets on the shares going up and going down (shorting). Share CFDs can be useful for short to mid term speculative trading. They are also a potentially attractive product for investors with share portfolios who might be looking to hedge risk in the short or medium term. CFDs aren’t very attractive for long term holding because of overnight holding costs.

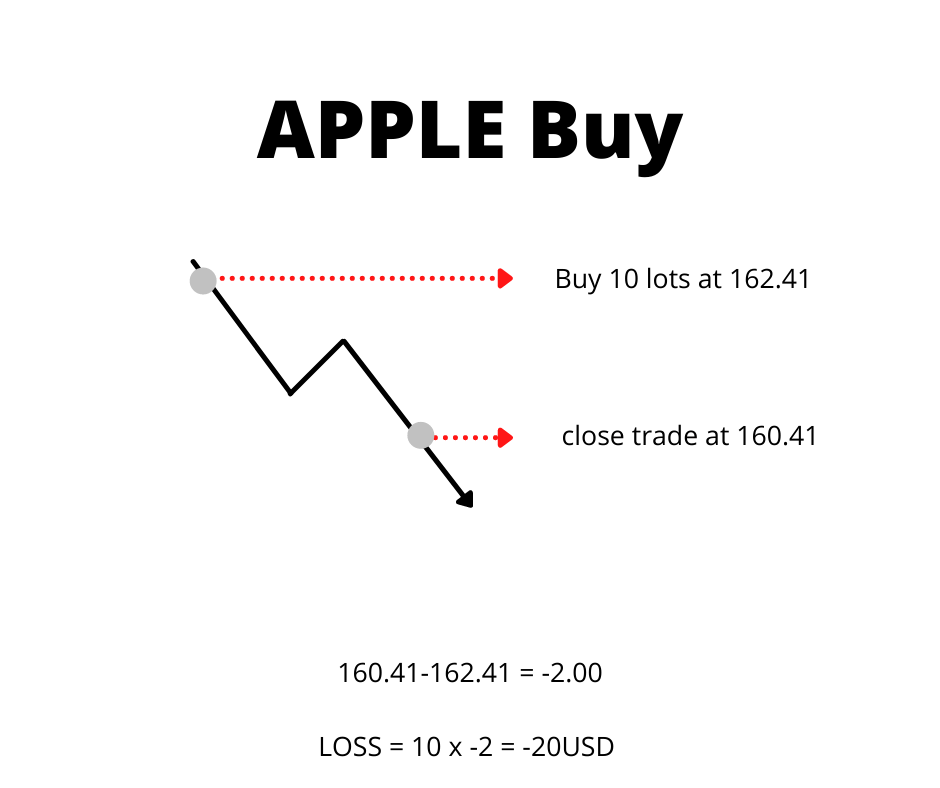

Apple stock CFDs trading example:

CFD trading involves using lot sizes. Different brokers may have different contract sizes per lot, so it’s essential that you check this before you place any trades. If the contract size for 1 lot on Apple stock CFDs is 10, this means that when you open a 1 lot trade on Apple, you would be buying or selling the equivalent of 10 shares. If the contract size for 1 lot is 1, then you would be buying or selling 1 Apple Share CFD.

For this example let’s assume that the broker which we are using has a contract size of 1 per lot for Apple CFDs. If you believed the price of Apple’s stock would go up, you could go long at 10 lots. With a buy price of 162.41, if the price went up to 164.41, you would profit 20 USD, ignoring overnight holding charges. If it fell by the same amount to 160.41, you would lose 20 USD.

Want to know more about FX Trading? Check our article here.

Interested in trading CFDs on indices. Find out more about it here.

Ready to start trading? Find you Forex and CFD broker.

Or try our unique filtration system on our homepage.