Broker Review Contents

Huobi Review

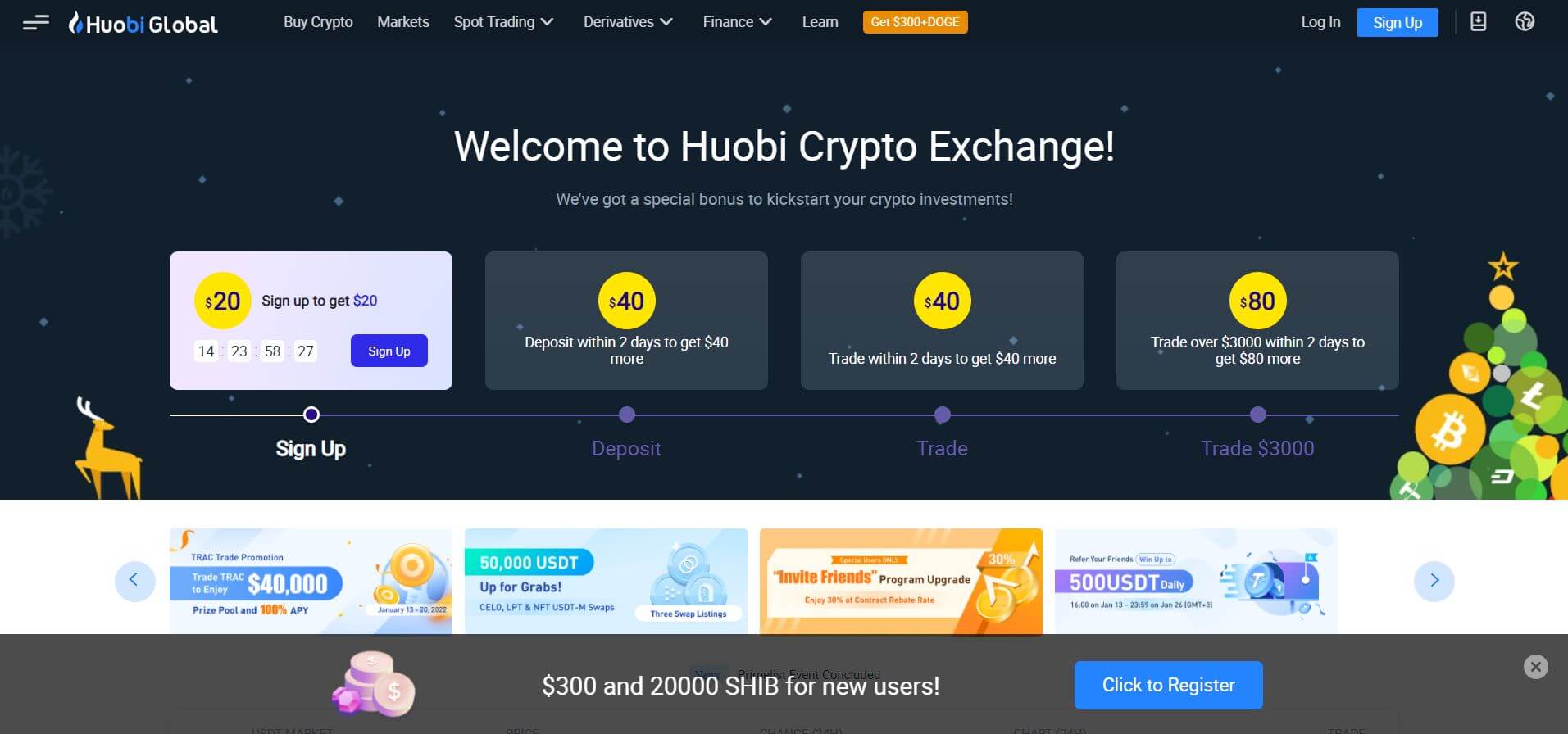

Huobi is a cryptocurrency exchange which was established in 2013. Traders can access a wide range of products including crypto spot and derivatives.Huobi is one of the world’s largest and longest-established cryptocurrency exchanges, offering a wide range of digital asset trading, derivatives, staking, DeFi access, and advanced financial products. Since its launch in 2013, Huobi has evolved into a major global platform with millions of users, deep liquidity, and a comprehensive suite of services tailored to both retail and professional crypto traders.

This 2026 review delves into Huobi’s ecosystem, regulation and safety, supported markets, fee structure, platforms and tools, security measures, customer support, and overall suitability for different types of traders.

Browser based platform and mobile apps for iPhone, Android, and tablets are among the online trading platforms offered by Huobi.

Huobi Technology (Gibraltar) Co. Ltd, is a fully licensed and regulated DLT service provider in Gibraltar (“Huobi Gibraltar”). .

Huobi is a spot and derivatives cryptocurrency exchange. This means that Huobi offer products suitable for both investors and speculators. When you trade the spot market you own the actual coins which you buy and sell. Derivative markets allow you to speculate and trade on the price of a coin without owning it.

A minimum deposit of 100USD is required for a live account. Huobi, on the other hand, provides a free demo account that you may utilize to experiment and familiarize yourself with their platform. Huobi Technology (Gibraltar) Co. Ltd, is already a fully licensed and regulated DLT service provider in Gibraltar (“Huobi Gibraltar”). Huobi was established in 2013 and their head office is in Seychelles. Before we get into the specifics of Huobi’s spreads, fees, platforms, and trading tools, you might want to open the their website in a new tab by clicking the button below to get the most up-to-date information directly from the company.

Disclosure: If you sign up with a broker through one of our links, we may receive a commission.

Company Background & History

Founded in 2013 by Leon Li, Huobi began as a Bitcoin exchange in China and rapidly expanded its services globally. In response to regulatory changes, Huobi reorganized its operations to focus on compliant markets, maintaining multiple regional entities and adjusting services to meet local regulations.

Over the years, Huobi has built a wide product ecosystem spanning spot trading, futures and derivatives, margin trading, staking, lending, portfolio management tools, and yield products. Its long operational history and scale have made it a recognizable brand in the crypto space.

Regulation & Compliance

Global Presence & Licensing

As a global platform, Huobi operates through different legal entities depending on jurisdiction. In regions with clear regulatory frameworks, Huobi entities have sought compliance with local licensing requirements. However, due to the rapidly evolving nature of crypto regulation, availability and features may vary by region.

Unlike traditional forex brokers regulated by financial authorities like the FCA, ASIC or CySEC, crypto exchanges operate under jurisdictional crypto laws that differ widely. In markets where regulations are strict (e.g., the U.S.), Huobi may restrict services or operate with tailored offerings through licensed partners.

KYC & AML Standards

Huobi enforces Know Your Customer (KYC) and Anti-Money Laundering (AML) policies to prevent fraud and illegal activity. Users are typically required to verify identity before accessing full trading features, higher withdrawal limits, and advanced products.

The exchange maintains compliance with international financial crime standards and requires documentation for identity verification such as government ID and proof of address.

Protection Measures

Although crypto exchanges do not provide the same investor protections as regulated financial brokers (e.g., deposit insurance or segregated client funds under banking rules), Huobi emphasizes internal risk controls, secure custody practices, and transparent operational frameworks where possible.

Markets & Supported Assets

Huobi is renowned for its wide selection of cryptocurrencies and trading pairs.

Spot Trading

The spot market on Huobi includes:

- Major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH)

- Mid-cap and emerging altcoins

- Stablecoin pairs (e.g., USDT, USDC, HUSD)

- Some region-specific token listings depending on regulatory status

The exchange frequently updates supported assets based on liquidity, project fundamentals, and compliance evaluation.

Derivatives

Huobi’s derivatives section provides access to:

- Perpetual futures (e.g., BTC/USDT, ETH/USDT)

- Quarterly futures contracts

- Leveraged token products

Traders can choose different leverage levels depending on risk appetite and product type.

Margin Trading

Margin trading allows users to borrow funds against collateral to amplify positions. Available assets and leverage limits are determined by market conditions and trader verification level.

Staking & Earn Products

Huobi offers staking and yield products, including:

- Locked/locked staking with fixed or variable APY

- Flexible savings accounts

- Liquidity mining and DeFi-like yield options

These products allow users to earn passive income on idle crypto assets.

Trading Platforms & User Experience

Web Platform

Huobi’s web interface is fully featured, with:

- Real-time charting and order books

- Multiple order types (market, limit, stop-limit)

- Watchlists and portfolio trackers

- Integrated news feeds and market insights

The interface allows both beginners and experienced traders to navigate markets, place orders, and monitor performance.

Mobile App

Huobi’s mobile app (iOS and Android) mirrors most desktop functionality, enabling on-the-go trading, alerts, quick deposits/withdrawals, and portfolio management.

API Access

For advanced traders and developers, Huobi provides an API for algorithmic trading, custom tools, and automated execution across supported markets.

Fees & Pricing Structure

Spot Trading Fees

Huobi uses a tier-based fee model where fees decrease as trading volume increases or if users hold and use the exchange’s native token for fee rebates (often called HT or similar depending on the product ecosystem).

Typical fee tiers include:

- Maker fee: often low or discounted with volume/holding requirements

- Taker fee: competitive relative to major global exchanges

Fee discounts can be applied based on 30-day trading volume and holdings of the platform’s native token.

Derivatives Fees

Futures and perpetual contracts carry distinct maker/taker fee schedules. Fees vary by contract type and trading volume, and may include funding rates for perpetual swaps.

Margin Interest & Borrowing Costs

Margin positions incur interest on borrowed amounts. Rates depend on asset type, duration, and market demand.

Deposit & Withdrawal Fees

- Deposits: Most crypto deposits are free, though network fees apply.

- Withdrawals: Withdrawal fees are determined by blockchain network costs and vary by coin.

Fiat options vary by region and payment provider.

Security Measures

Security is a critical concern in crypto trading. Huobi employs multiple layers of protection:

- Cold Storage: A significant portion of user assets is held in offline cold wallets to minimize hack risk.

- Two-Factor Authentication (2FA): Mandatory 2FA protects account access.

- Withdrawal Whitelisting: Users can restrict withdrawals to a pre-approved list of wallet addresses.

- Anti-Phishing Codes: Adds an extra layer of protection against phishing attempts.

- Security Notifications: Alerts for unusual login or withdrawal activity.

Although no exchange can guarantee complete protection, Huobi’s security infrastructure is designed to mitigate common threats.

Deposits and Withdrawals

Supported Methods

Cryptocurrency deposits are typically free and processed reasonably quickly, subject to blockchain network confirmations.

Fiat funding and withdrawals depend on the user’s region and supported payment methods, which may include:

- Bank transfers

- Credit/debit cards

- E-wallet partners

- Third-party services in select markets

Verification requirements apply to fiat transactions for compliance.

Processing Times & Limits

Withdrawal processing times vary by asset and network congestion. Verified users generally have higher daily limits than unverified accounts. KYC completion is recommended to maximize deposit/withdrawal flexibility.

Customer Support & Service Quality

Huobi provides customer support through:

- Live chat

- Email support tickets

- Help center with documentation

Response times vary, and support quality can be influenced by ticket volume and regional service availability. Comprehensive FAQ and help sections assist with common queries.

Education & Research Tools

While not as education-focused as some retail forex brokers, Huobi provides market resources such as:

- Market news and analysis

- Price alerts

- Asset information pages

- Glossary and guides for trading basics

These resources help traders stay informed, though deep strategy tutorials may be limited compared to dedicated trading educators.

Pros and Cons of Huobi

Pros

- One of the largest and most liquid crypto exchanges globally

- Wide range of supported assets including spot, futures, and staking

- Competitive fee structure with tier discounts

- Multiple platforms: web, mobile, API

- Strong security protocols

Cons

- Regulatory availability varies by region (some markets restricted)

- Not a traditional licensed forex broker — crypto exchange regulations differ

- Customer support can be inconsistent depending on region

Who Huobi Is Best For

Huobi suits:

- Active crypto traders seeking a wide range of coins and pairs

- Derivatives traders looking for futures and perpetual contracts

- Users seeking staking and yield products

- Developers and algorithmic traders using APIs

It may be less suitable for:

- Traders looking for forex and traditional asset CFDs outside of crypto

- Users in regions where services are limited by regulation

- Beginners seeking intensive educational content

Risk Warning

Cryptocurrency trading carries significant risk due to price volatility, leverage, and regulatory uncertainty. Traders should only invest capital they can afford to lose and understand market risks before trading.

What are Huobi’s spreads & fees?

Huobi, like most exchanges, charges a fee based on the transactions which occur on the exchange. These can depend on the coin which you trade, as some coins have higher trading and withdrawal fees.

Choosing at what time of the day and through which coins to transact can lower your fees.

Before you complete a trade on Huobi’s platform, it will show you a breakdown of all the fees which you may incur. Checking these fees before completing the trade could save you money.

As Huobi is an exchange the spreads very depending on trader activity. Any spreads displayed on our website are for information purposes only.

Please visit Huobi’s website for current spreads and fees.

As you can see, Huobi’s BTC/USDT spread was 0.01 USDT when we wrote this review. This is low when compared to the average BTC/USDT spread of 8.00.

What can you trade with them?

Over 900 different coins are available to trade at Huobi.

Below, we’ve summarized the offering of Huobi’s several types of markets, as well as the markets offered by some of their competitors for comparison.

| MARKET | Huobi Exchange | Binance | Crypto.com |

| Spot Trading | YES | YES | YES |

| Futures Trading | YES | YES | YES |

| launchpad | NO | YES | YES |

| Options Trading | NO | YES | NO |

| DEX Trading | NO | YES | NO |

| NFT Trading | NO | YES | YES |

| Borrow/lend Crypto | YES | YES | YES |

| Staking | YES | YES | YES |

What’s the Huobi trading experience like?

1) Platforms and apps

Huobi offers a web based platform which allows you to use it on any device which has a browser.

They offer Android and iOS mobile apps, making it easy to keep track of and execute trades while on the go.

2) Executing Trades

You can trade as little as 1USD with Huobi. Depending on the cryptocurrency you trade, this may differ. Maximum trade size depends on the available liquidity on the exchange.

Margin requirements vary by account, and instrument, as they do with most exchanges.

They offers leverage as high as 5x for spot trading. For derivatives they offer up to 100x leverage.

Stop losses, trailing stop losses, limit orders, price alerts, api trading and other features are available. Here you can find a list of all of Huobi’s account features.

We have included a list of some of the most common funding options that Huobi provides to its traders.

- Crypto

- Bank Transfer

- Card

3) Client support

Huobi offers support in languages like English, Chinese, Russian, German, Spanish, French, Turkish, Vietnamese, Portuguese, Italian and more.

4) What you’ll need to open an account with Huobi

Most crypto exchanges allow you to open an account without providing documents. This type of account will be severely limited in terms of maximum deposit and withdrawals.

In order to have higher deposit and withdrawal limits with them you need to pass verification by providing the following documents:

- a color copy of your passport, driver’s license, or other government-issued identification

- a three-month utility bill, bank or credit card statement that shows your current address

Huobi may also ask you to go through a verification of identity via your laptop or phone camera.

If you decide to trade using leverage, you’ll also need to answer a few questions regarding your trading experience.

You may be able to explore Huobi’s platform right away, but as mentioned before until you pass verification, your deposits and withdrawals will be capped. Verification depending on the circumstances could take from a few hours up to a few days.

To begin the on-boarding process with Huobi, you can go to their website.

Compare Crypto Exchanges here.

Final Verdict

In 2026, Huobi remains a leading global crypto exchange, offering a comprehensive ecosystem for digital asset trading, derivatives, staking, and portfolio management. Its global footprint, broad asset support, and advanced platform offerings make it a strong choice for both intermediate and advanced crypto traders. While regulatory coverage varies by region, and customer support responses can fluctuate, Huobi’s deep liquidity and competitive pricing hold strong appeal.

For traders who prioritize extensive market access, multiple trading tools, and diverse digital asset options, Huobi is among the most capable exchanges in 2026.

FAQs

- Is Huobi safe to use?

Huobi uses multi-layer security including cold storage and 2FA, but crypto trading always carries risk. - Can I trade crypto derivatives on Huobi?

Yes futures and perpetual contracts are available with leverage based on eligibility. - What assets can I trade on Huobi?

Spot crypto, derivatives, margin markets, ETFs, and staking products (region dependent). - Does Huobi charge fees for deposits?

Crypto deposits are typically free; fiat fees vary by method and region. - Do I need to complete KYC on Huobi?

Yes KYC verification increases deposit and withdrawal limits and ensures compliance.