In the fast-moving forex trading world, brokers like Forex.com and Equiti are shaping the industry with strong platforms and tailored experiences. Forex.com brings the strength of global regulation and broad market access, while Equiti is quickly emerging as a flexible and expanding broker, especially in the MENA region.

This detailed analysis looks at how both brokers compare in terms of regulation, trading conditions, technology, and features that matter most to traders in 2025.

Broker Review Contents

Company Overview

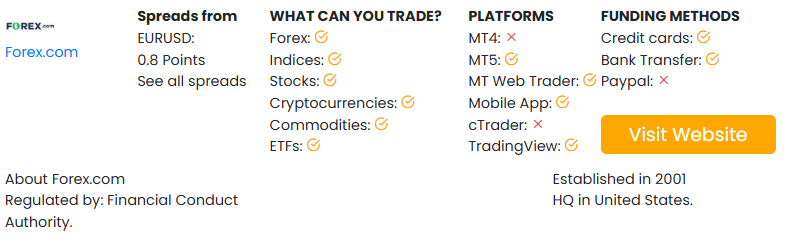

Forex.com is a globally recognized broker operated by StoneX Group Inc., a NASDAQ-listed financial services company. It serves traders with a diverse product offering and deep regulatory backing.

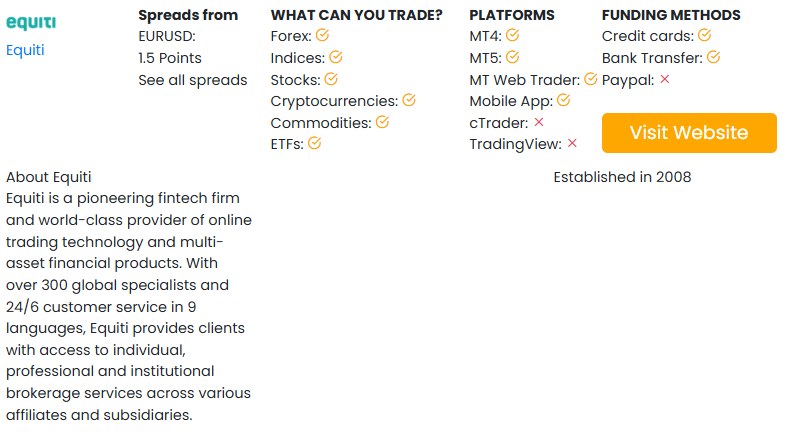

Equiti Group is a multi-regulated broker headquartered in the Middle East, offering competitive spreads, localized support, and growing technology capabilities for international and regional traders.

| Feature | Forex.com | Equiti |

|---|---|---|

| Founded | 2001 | 2008 |

| Headquarters | USA | Jordan / UAE |

| Regulatory Oversight | CFTC, FCA, ASIC, IIROC, CySEC | FCA, DFSA, JSC, CMA, FSC |

| Focus | Global retail and institutional | MENA, Africa, and global retail |

Regulatory Coverage and Client Security

Forex.com offers regulation in:

- United States (CFTC/NFA)

- United Kingdom (FCA)

- Australia (ASIC)

- Canada (IIROC)

- Cyprus (CySEC)

Equiti is regulated by:

- FCA (UK)

- DFSA (UAE)

- JSC (Jordan)

- CMA (Kenya)

- FSC (Mauritius)

Forex.com is more heavily regulated in top-tier markets, while Equiti offers solid regional regulation and compliance, especially appealing to traders in the Middle East and Africa.

Platforms and Trading Technology

Forex.com provides:

- MetaTrader 4 and 5

- Advanced Trading Platform (desktop)

- TradingView integration

- WebTrader

- Mobile apps

Equiti offers:

- MetaTrader 4 and 5

- Equiti Trader (proprietary platform)

- Mobile app with advanced analytics

- Equiti Copy Trading (select regions)

Forex.com focuses on platform variety and professional-grade integrations. Equiti delivers a clean interface with growing proprietary tools and social features for broader appeal.

Instruments and Asset Classes

| Asset Type | Forex.com | Equiti |

|---|---|---|

| Forex Pairs | 80+ | 60+ |

| Indices | Yes | Yes |

| Commodities | Yes | Yes |

| Metals | Yes | Yes |

| Stocks (CFDs) | Yes | Yes |

| Cryptocurrencies | Yes | Yes |

| ETFs | Yes (CFDs) | No |

| Futures | No | No |

Forex.com has broader market coverage, including ETF CFDs and more currency pairs. Equiti covers most major instruments and continues to expand its offering, particularly in regional markets.

Account Types and Minimum Deposits

Forex.com offers:

- Standard

- RAW Spread (Commission-based)

- DMA (Direct Market Access)

- Islamic (swap-free)

Equiti offers:

- Executive Account (Standard)

- Premiere Account (RAW spread)

- Islamic Account

Minimum deposits:

- Forex.com: $100

- Equiti: $500 (varies by region)

Forex.com is more accessible to smaller retail traders, while Equiti targets mid-tier traders with its higher deposit requirements and more regionally tailored accounts.

Spreads and Trading Fees

Forex.com:

- Spreads: From 1.0 pip (Standard), from 0.2 pip + $5/lot (RAW)

- No deposit fees

- Inactivity fee after 12 months

Equiti:

- Executive Account: From 1.6 pips

- Premiere Account: From 0.0 pip + $7/lot

- No deposit/withdrawal fees (regional)

- No inactivity fee

Forex.com offers tighter spreads for RAW and DMA accounts, while Equiti provides competitive pricing, especially for MENA-based traders seeking local currency deposits.

Leverage and Margin Conditions

| Region | Forex.com | Equiti |

|---|---|---|

| US Clients | 1:50 | Not available |

| EU/UK Retail | 1:30 | 1:30 |

| Global (Pro) | Up to 1:200 | Up to 1:500 |

Equiti provides significantly higher leverage in offshore jurisdictions, which appeals to more aggressive traders. Forex.com is better suited for clients in heavily regulated regions needing conservative caps.

Education and Tools

Forex.com includes:

- Autochartist

- Trading Central

- Strategy optimizer

- Integrated market analysis and news

- Webinars, eBooks, and research articles

Equiti offers:

- Basic and advanced video tutorials

- Market insights

- Equiti Academy

- Copy trading (in select regions)

Forex.com has more established institutional-level analytics, while Equiti focuses on digestible content for intermediate traders looking to upskill.

Mobile Trading Experience

Forex.com:

- Dedicated mobile app for iOS/Android

- Full feature access (orders, alerts, charts)

- TradingView integration

Equiti:

- Equiti Trader app with price alerts, portfolio view, and one-click trading

- Available for iOS/Android

- Integration with MT4/MT5

Both brokers offer sleek, fast mobile platforms, though Forex.com supports more advanced analytical tools directly from mobile.

Customer Service

Forex.com:

- 24/5 global support

- Phone, live chat, and email

- Fast onboarding and account verification

Equiti:

- 24/6 multilingual support

- Local support teams across the Middle East and Africa

- Personalized relationship managers (VIP clients)

Equiti offers a more localized support experience for regional users, while Forex.com provides reliable assistance across broader time zones.

Comparison Summary Table

| Feature | Forex.com | Equiti |

|---|---|---|

| Regulation | US, UK, AU, CA, EU | UK, UAE, Kenya, Jordan, Mauritius |

| Minimum Deposit | $100 | $500 |

| Spreads (Standard) | From 1.0 pip | From 1.6 pips |

| RAW Spread Option | Yes (0.2 pip + $5/lot) | Yes (0.0 pip + $7/lot) |

| Max Leverage | Up to 1:200 | Up to 1:500 |

| ETF Trading | Yes | No |

| Copy Trading | No | Yes (limited regions) |

| Education & Research | Institutional grade | Intermediate level |

| Ideal User | Regulated market traders | Regional MENA and offshore users |

Forex.com is a powerful option for traders seeking global reach, institutional-grade tools, and diverse trading instruments. It excels in regulation, platform flexibility, and raw pricing for professionals.

Equiti is a growing broker that shines in regions like the Middle East and Africa. It’s ideal for traders seeking higher leverage, copy trading options, and regional support with multilingual service.