Both Forex.com and Admiral Markets (now operating as Admirals) are globally trusted brokers offering forex and CFD trading. Backed by strong regulatory licenses and comprehensive platforms, these two brokers appeal to a wide range of traders—from beginners to institutional-level investors. This comparison takes a deep dive into their features, helping you determine which is best aligned with your trading goals in 2025.

Broker Review Contents

Broker Overview

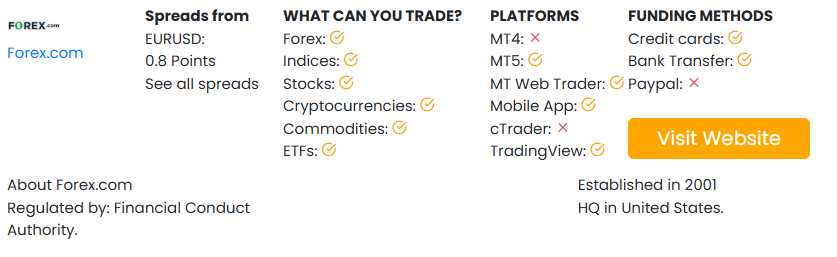

Forex.com was established in 2001 and is operated by GAIN Capital, a subsidiary of StoneX Group Inc (NASDAQ: SNEX). It’s known for its high compliance standards, trading tools, and global presence.

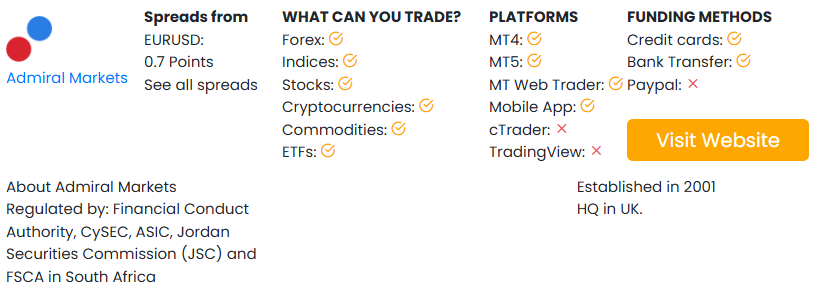

Admiral Markets, rebranded as Admirals, was founded in 2001 in Estonia and has built a strong reputation in the EU, UK, and globally for offering low spreads, robust platforms, and user education.

| Feature | Forex.com | Admiral Markets (Admirals) |

|---|---|---|

| Founded | 2001 | 2001 |

| Headquarters | USA | Estonia |

| Global Reach | North America, EU, Australia | EU, UK, Latin America, Asia |

| Parent Company | StoneX Group (Publicly listed) | Private entity |

Regulation and Safety

Forex.com is regulated by:

- CFTC and NFA (USA)

- FCA (UK)

- ASIC (Australia)

- IIROC (Canada)

- CySEC (EU)

Admirals is regulated by:

- FCA (UK)

- ASIC (Australia)

- CySEC (Cyprus)

- JSC (Jordan)

- EFSA (Estonia)

Both brokers are under the oversight of top-tier regulators, although Forex.com has a more dominant presence in North America while Admirals offers slightly more flexibility to European and offshore traders.

Trading Platforms

Forex.com offers:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Advanced Trading Platform (desktop)

- WebTrader

- Mobile apps

- TradingView integration

Admiral Markets provides:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Supreme Edition (custom MT4/MT5 upgrade)

- Mobile and web-based platforms

Forex.com benefits from proprietary software and TradingView integration, while Admirals excels with its MT Supreme Edition add-on, delivering deeper market analysis tools.

Available Instruments

| Asset Type | Forex.com | Admiral Markets |

|---|---|---|

| Forex Pairs | 80+ | 45+ |

| Indices | Yes | Yes |

| Commodities | Yes | Yes |

| Stocks (CFDs) | Yes | Yes |

| ETFs | Yes | Yes |

| Cryptocurrencies | Yes | Yes |

| Bonds | No | Yes |

While both brokers support major asset classes, Admirals also allows CFD trading on bonds, adding more flexibility for portfolio diversification.

Account Types and Minimum Deposits

Forex.com accounts:

- Standard (spread-based)

- Commission (RAW)

- DMA (Direct Market Access)

- Islamic (swap-free)

Admiral Markets accounts:

- Trade.MT5

- Zero.MT5

- Invest.MT5 (real stock and ETF purchases)

- Islamic account available

Minimum deposit:

- Forex.com: $100

- Admiral Markets: $25 (for Trade.MT5), $100 for Zero.MT5

Forex.com offers more options for institutional-style execution (DMA), while Admirals provides the opportunity to invest directly in real stocks and ETFs, not just CFDs.

Spreads and Commissions

Forex.com:

- Standard account spreads: From 1.0 pip

- RAW: From 0.2 pip + $5/lot

- DMA: Institutional pricing

- No deposit fees, inactivity fee after 12 months

Admiral Markets:

- Trade.MT5: Spreads from 0.5 pips (no commission)

- Zero.MT5: Spreads from 0.0 pips + commission starting at $3

- No deposit or withdrawal fees on most methods

Admirals has an edge in spread-based pricing for active traders, especially with its Zero.MT5 account, while Forex.com offers more flexible tiers across user types.

Leverage and Margin

| Region | Forex.com | Admiral Markets |

|---|---|---|

| UK/EU (Retail) | 1:30 | 1:30 |

| USA | 1:50 (regulated max) | Not available |

| Global | Up to 1:200 | Up to 1:500 |

Admirals offers higher leverage in its offshore accounts, which may appeal to high-risk traders. Forex.com is more focused on conservative, compliant leverage limits.

Tools, Analysis, and Education

Forex.com provides:

- Autochartist

- Trading Central

- Strategy optimizer

- TradingView charts

- Educational webinars

Admiral Markets offers:

- Premium Analytics (Dow Jones, Trading Central, Acuity)

- Economic calendar and sentiment indicators

- Supreme Edition plugin for MT4/MT5

- Rich education section with courses, articles, and webinars

Admirals wins in terms of customized tools and investor education, especially with the integration of real-time sentiment analysis and Supreme Edition add-ons.

Mobile Trading

Forex.com mobile app:

- Real-time quotes and alerts

- Secure trading

- Seamless execution

- Available on Android and iOS

Admiral Markets mobile app:

- Custom-built Admirals app for account management

- Also supports MT4 and MT5 mobile apps

- Easy charting and funding features

Both brokers have solid mobile platforms, but Admirals offers a more modern mobile experience through its proprietary app.

Customer Support

Forex.com:

- 24/5 multilingual support

- Live chat, phone, email

- Local offices in major financial hubs

Admiral Markets:

- 24/5 multilingual support

- Localized help centers

- Fast email/chat response

Both companies deliver top-tier customer service with fast response times and dedicated onboarding.

Comparison Summary Table

| Feature | Forex.com | Admiral Markets (Admirals) |

|---|---|---|

| Regulation | US, UK, EU, AU, CA | UK, EU, AU, Jordan, Estonia |

| Platforms | MT4, MT5, Advanced, TradingView | MT4, MT5, Supreme Edition |

| Instruments | Forex, CFDs, ETFs, Crypto | Forex, CFDs, Stocks, Bonds, Crypto |

| Account Types | Standard, RAW, DMA, Islamic | Trade.MT5, Zero.MT5, Invest.MT5 |

| Minimum Deposit | $100 | $25–$100 |

| Spreads | From 0.2 pip + $5 | From 0.0 pip + $3 |

| Leverage | Up to 1:200 | Up to 1:500 |

| Tools & Education | Autochartist, Trading Central | Supreme Edition, Sentiment Tools |

| Best For | Regulated regions, pro traders | EU traders, tool-rich MT users |

Which one is the best?

Forex.com is ideal for traders who value regulation, platform depth, and professional execution options. It’s especially suitable for users in the US and highly regulated markets. The availability of DMA accounts makes it a strong choice for those looking to scale.

Admiral Markets shines for European and offshore traders who want competitive pricing, a rich MT5 environment, and comprehensive educational support. Its Invest.MT5 account is also ideal for those interested in real asset investing alongside CFD trading.