As the forex trading landscape becomes increasingly competitive, traders are looking for brokers that not only offer tight spreads and powerful platforms but also the right mix of regulation, support, and educational tools. In this comparison of Forex.com and Eightcap, we examine how these two brokers stack up in 2025 across key categories that matter to traders.

Broker Review Contents

Company Background

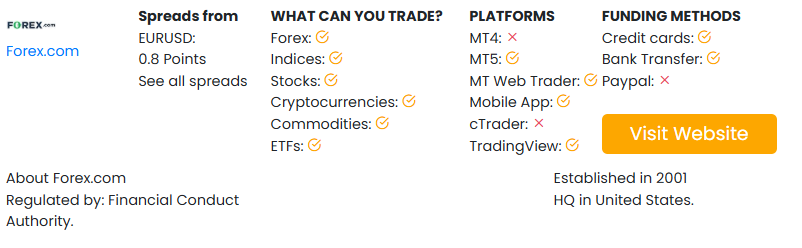

Forex.com is a global brokerage powerhouse under the publicly traded StoneX Group. It has been operating since 2001 and offers multi-asset access to traders across major regions.

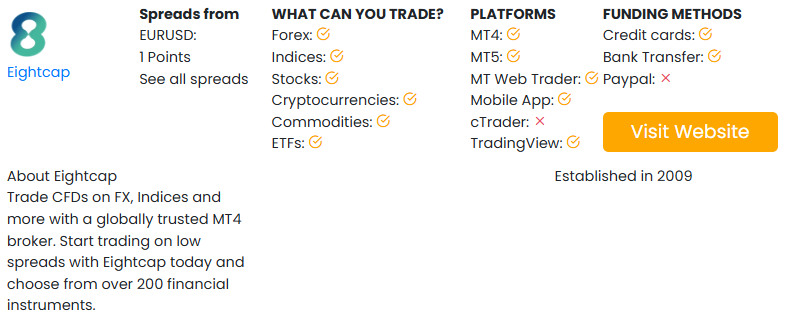

Eightcap, founded in 2009 and based in Melbourne, Australia, has rapidly gained attention among forex and CFD traders for its ultra-competitive spreads and crypto offerings.

| Feature | Forex.com | Eightcap |

|---|---|---|

| Founded | 2001 | 2009 |

| Headquarters | USA | Australia |

| Regulation | CFTC, FCA, ASIC, IIROC, CySEC | ASIC, SCB (Bahamas) |

| Parent Company | StoneX Group (NASDAQ: SNEX) | Independent |

| Client Focus | Global retail & institutional | Crypto and forex traders |

Regulation and Trust

Forex.com operates under a globally trusted framework with licenses in the U.S., UK, Canada, Australia, and the EU. This multi-jurisdictional regulation offers added confidence for traders looking for compliance and safety.

Eightcap is regulated by:

- Australian Securities and Investments Commission (ASIC)

- Securities Commission of The Bahamas (SCB)

While Eightcap’s regulatory profile is strong, Forex.com has deeper and broader regulatory coverage, including access to U.S. markets—something Eightcap does not offer.

Trading Platforms

Forex.com offers:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Advanced Trading Platform

- TradingView integration

- WebTrader and native mobile apps

Eightcap provides:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Capitalise.ai for no-code strategy automation

- Web and mobile trading

Both brokers offer MT4 and MT5, but Eightcap’s integration with Capitalise.ai is particularly appealing to traders interested in strategy automation without coding skills. Forex.com, however, offers more advanced technical analysis and institutional-grade execution features.

Instruments and Market Access

| Asset Type | Forex.com | Eightcap |

|---|---|---|

| Forex Pairs | 80+ | 55+ |

| Indices | Yes | Yes |

| Commodities | Yes | Yes |

| Cryptocurrencies | Yes | Yes (250+ crypto CFDs) |

| Stocks (CFDs) | Yes | Yes |

| ETFs | Yes (CFDs) | No |

| Futures | No | No |

| Precious Metals | Yes | Yes |

Eightcap stands out for its enormous crypto CFD offering, while Forex.com shines in traditional market depth and range, including ETFs.

Spreads and Fees

Forex.com:

- Standard Account: Spreads from 1.0 pip

- Commission Account: From 0.2 pip + $5 per lot

- No deposit fees; inactivity fee after 12 months

Eightcap:

- Raw Account: From 0.0 pip + $3.50 per lot

- Standard Account: From 1.0 pip

- No deposit/withdrawal or inactivity fees

Eightcap edges ahead in terms of raw spread pricing and affordability for active scalpers or day traders. Forex.com, however, provides more account types to accommodate different trader levels.

Account Types

Forex.com:

- Standard

- Commission (RAW)

- DMA (Direct Market Access)

- Swap-free (Islamic)

Eightcap:

- Standard

- Raw (ECN-style)

- Swap-free option on request

Forex.com supports a broader range of trading styles including DMA for professionals. Eightcap offers competitive simplicity with lower fees on raw spreads.

Leverage and Margin

| Region | Forex.com | Eightcap |

|---|---|---|

| UK/EU Retail | 1:30 | 1:30 |

| Global Clients | Up to 1:200 | Up to 1:500 |

| U.S. Traders | 1:50 | Not accepted |

Eightcap offers higher leverage globally for traders outside strict jurisdictions. Forex.com prioritizes regulatory compliance and offers safer leverage caps.

Education and Tools

Forex.com:

- Trading Central

- Autochartist

- Strategy Optimizer

- Integrated TradingView

- Daily webinars and tutorials

Eightcap:

- Capitalise.ai (automated trading strategies)

- Blog, webinars, and trading academy

- Economic calendar

Forex.com is better suited for research-focused traders and those relying on professional analysis. Eightcap leans into automation and crypto-specific tools.

Mobile Trading

Forex.com:

- Proprietary trading app

- Full-featured charts and trade management

- TradingView syncing

Eightcap:

- MT4 and MT5 mobile apps

- Clean and responsive UI

- Capitalise.ai mobile companion

Both brokers offer solid mobile options, with Forex.com taking a lead on multi-functionality and customization.

Customer Support

Forex.com:

- 24/5 global support

- Live chat, email, and phone

- Regional assistance in major markets

Eightcap:

- 24/5 support

- Email, phone, and chat

- Personalized account managers for high-volume traders

Both provide efficient service, though Forex.com has a wider support infrastructure.

Summary Table

| Feature | Forex.com | Eightcap |

|---|---|---|

| Regulation | US, UK, CA, EU, AU | AU + Bahamas |

| Platforms | MT4, MT5, Web, TradingView | MT4, MT5, Capitalise.ai |

| Crypto CFDs | Yes (moderate range) | Yes (250+ pairs) |

| Leverage | Up to 1:200 | Up to 1:500 |

| Stocks and ETFs | Yes | Stocks only |

| Spreads (RAW) | From 0.2 pip + $5/lot | From 0.0 pip + $3.5/lot |

| Tools and Analysis | Advanced technical tools | No-code automation tools |

| Ideal For | Multi-asset, institutional traders | Crypto-focused, automation fans |

Forex.com is a highly trusted global broker suitable for traders seeking regulation, multi-asset exposure, and advanced research tools. It’s ideal for those operating in regulated environments who value reliability and long-term security.

Eightcap offers compelling advantages for traders interested in crypto, automation, and lean pricing. With over 250 crypto CFDs and Capitalise.ai integration, it appeals to tech-savvy traders, algo enthusiasts, and crypto fans looking for a streamlined experience.