In a fast-paced trading environment, choosing the right broker could be the defining factor between profit and stagnation. Forex.com and DeltaStock both cater to forex and CFD traders, but they differ significantly in terms of technology, regulation, market access, and overall experience.

While Forex.com boasts global reach and deep liquidity backed by a listed U.S. parent company, DeltaStock operates as a European-centric broker with solid regulation and a proprietary platform. Let’s explore how they compare in key areas that matter most to retail and pro traders in 2025.

Broker Review Contents

Broker Background

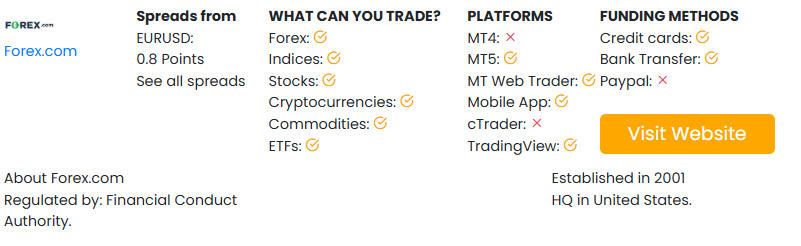

Forex.com is one of the most widely known brokers globally. Owned by StoneX Group (NASDAQ: SNEX), it offers a powerful suite of platforms and is trusted across continents.

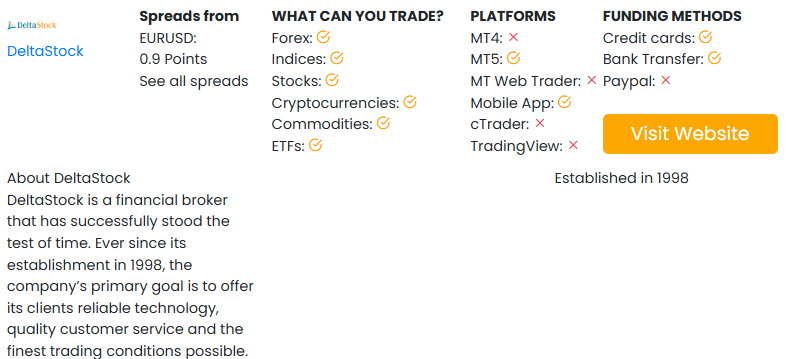

DeltaStock, based in Bulgaria and regulated within the European Union, has been active since 1998 and delivers a strong regional offering in Europe, focusing on transparency, spreads, and stable technology.

| Feature | Forex.com | DeltaStock |

|---|---|---|

| Founded | 2001 | 1998 |

| Headquarters | USA | Bulgaria |

| Regulatory Oversight | CFTC, FCA, ASIC, IIROC, CySEC | FSC Bulgaria (EU-regulated) |

| Parent Company | StoneX Group (NASDAQ: SNEX) | Independent |

| Primary Focus | Global retail and institutional | EU forex and CFD traders |

Regulation and Safety

Forex.com operates under multiple top-tier regulatory bodies, including:

- CFTC/NFA (USA)

- FCA (UK)

- ASIC (Australia)

- CySEC (Cyprus)

- IIROC (Canada)

DeltaStock is regulated by:

- FSC Bulgaria (Financial Supervision Commission)

While DeltaStock complies with MiFID II regulations, Forex.com provides a more globally diversified regulatory environment, including access to U.S. markets.

Trading Platforms

Forex.com offers a wide array of platforms:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Proprietary Advanced Trading Platform

- WebTrader

- Mobile app

- TradingView integration

DeltaStock provides:

- Delta Trading Platform (proprietary)

- MetaTrader 5

- Web and mobile trading

Forex.com shines with its integration of third-party analytics like TradingView and more versatile platforms. DeltaStock’s proprietary Delta Trading platform offers direct market access and useful tools for EU-based traders.

Market Access and Instruments

| Asset Type | Forex.com | DeltaStock |

|---|---|---|

| Forex Pairs | 80+ | 70+ |

| Indices | Yes | Yes |

| Commodities | Yes | Yes |

| Shares (CFDs) | Yes | Yes |

| ETFs | Yes | Yes |

| Futures | No | No |

| Bonds | No | Yes |

| Cryptocurrencies | Yes | Yes (Limited pairs) |

DeltaStock offers access to bonds, which is uncommon for many retail brokers. However, Forex.com has wider asset variety overall, especially for international clients.

Account Types and Minimum Deposit

Forex.com account types:

- Standard

- Commission (RAW spread)

- DMA (Direct Market Access)

- Islamic accounts

DeltaStock account options:

- Delta Trading account (STP)

- MetaTrader 5 account (with leverage customization)

Minimum deposit:

- Forex.com: $100

- DeltaStock: €100

Both brokers provide accessible account setups, but Forex.com offers more customization and trading tiers based on experience levels.

Spreads, Fees, and Pricing Models

Forex.com pricing:

- RAW spreads from 0.2 pip + $5/lot

- Standard spreads from 1.0 pip

- No deposit fees, inactivity charges after 12 months

DeltaStock pricing:

- Spreads from 0.5 pips (floating)

- No commissions on most accounts

- Commission model available for DMA orders

- No deposit/withdrawal fees

DeltaStock’s floating spreads and low fee setup are attractive for swing traders and beginners. Forex.com’s RAW and DMA pricing options provide more flexibility for professionals.

Leverage and Margin Requirements

| Region | Forex.com | DeltaStock |

|---|---|---|

| EU Retail | 1:30 | 1:30 |

| Global (Pro) | Up to 1:200 | Up to 1:200 |

| U.S. Clients | 1:50 (max allowed) | Not accepted |

Both brokers follow ESMA caps in the EU. Forex.com also accommodates U.S. traders, making it more globally accessible.

Research, Education, and Tools

Forex.com:

- Trading Central and Autochartist

- TradingView integration

- Strategy optimizer

- Daily analysis, economic calendar

- Webinars and tutorials

DeltaStock:

- Built-in technical analysis tools

- Daily market news

- Economic calendar

- Trading tutorials and guides

- Custom indicators on Delta platform

DeltaStock delivers solid research for EU-focused traders. Forex.com, with its premium tools like Trading Central, supports deeper technical and strategic trading.

Mobile Trading Experience

Forex.com mobile app:

- Full account management

- One-click execution

- Integrated charting and alerts

DeltaStock mobile:

- Proprietary Delta Trading mobile version

- MT5 mobile app available

- Basic execution with real-time quotes

Forex.com offers a more polished mobile interface with broader integrations. DeltaStock’s app is functional but lacks some advanced charting tools.

Customer Support

Forex.com:

- 24/5 global support

- Phone, chat, and email

- Regional offices in major countries

DeltaStock:

- Support via phone, email, and chat

- Available during market hours

- Primarily European language support

DeltaStock is ideal for EU traders looking for regional support. Forex.com caters to a global audience with multilingual, round-the-clock service.

Comparison Summary Table

| Feature | Forex.com | DeltaStock |

|---|---|---|

| Regulation | Global (Tier-1) | EU (FSC Bulgaria) |

| Minimum Deposit | $100 | €100 |

| Platforms | MT4, MT5, TradingView, WebTrader | Delta Trading, MT5 |

| Spreads | From 0.2 pip (RAW) | From 0.5 pips (floating) |

| Asset Coverage | Wide range incl. ETFs | Includes bonds, fewer crypto pairs |

| Education & Research | Extensive third-party tools | Solid but basic |

| Mobile App Quality | Advanced with alerts | Simple and functional |

| Ideal Audience | Global traders, institutional | EU-focused retail clients |

Forex.com provides a globally trusted, multi-platform trading environment suitable for both retail and professional clients. Its platform variety, tools, and global compliance make it an excellent choice for serious traders across markets.

DeltaStock, on the other hand, presents a compelling EU-focused alternative with its proprietary trading platform, bond market access, and transparent cost structure. It’s particularly appealing for traders within the European Economic Area looking for simplicity and control.