The energy market has settled down after the recent wild price swings. Traditional energy costs will stay high. Traditional energy companies profited more from rising prices. The XLE invests in conventional energy and energy-related enterprises in the United States. The XLE continues to rise in price. Until the trend goes downward, XLE will remain on top for a long time.

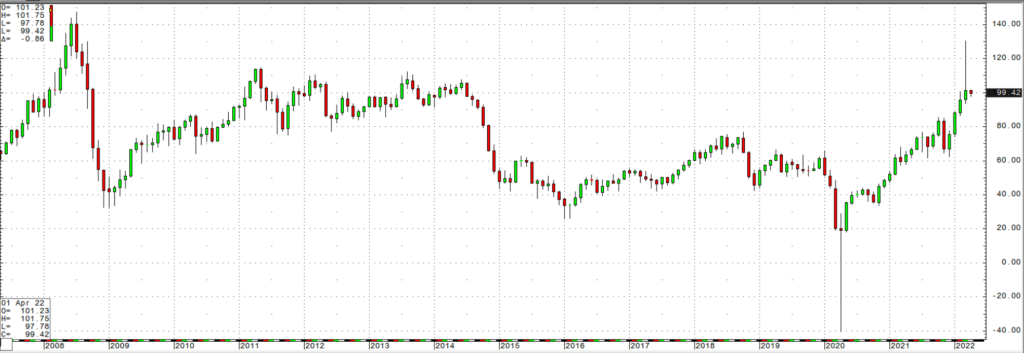

May NYMEX crude oil futures finished slightly below $100 per barrel at the end of last week. In March, the price of the energy commodity ranged from $93.55 to $130.60. The monthly chart displays the oil market’s extreme price swings in March.

Fossil Fuel Price Analysis

In the first quarter of 2022, crude oil rose for the seventh time in a row. The upward trend in crude oil prices continues. Even once the battle in Ukraine will be over, tensions between Washington and Moscow are likley to remain high. Russia is a powerful non-member of the world’s oil cartel but a member of the OPEC+. Oil and gas will be used by Russia as a political instrument. The United States’ energy policy, which favors various renewable fuels while restricting energy production and consumption, will begin to place downward pressure on output. Petroleum is the essential resource that keeps the globe running.

Energy Generation Resources Advantages

Traditional energy producers benefit from increased prices because they make more money when oil prices soar. Shareholders in US oil businesses, on the other hand, depend on the administration to produce returns. The government may exert political pressure on oil firms, raise taxes on idle leaseholds, and use other tactics, but this cannot legally prohibit them from profiting in a capitalist economy. As the epidemic overtook the energy market in early 2020, oil firms saw their profits plummet.

But the reality is that in a capitalist economy, the government cannot allow businesses to suffer as a result of rising market pricing. Russia may have added gasoline to the fire, but it was the US government’s energy, economic, and budgetary policies that started it all.

XLE Upward Trend

Across all asset classes, crowd behaviour that defines trends may be the best market technique. The crowd’s wisdom hints at a positive trend in XLE as of April 1. The APS will give a sales forecast for the ETF that contains the main integrated oil firms as well as shares of other conventional energy-related businesses if the trend changes.