Broker Review Contents

What Are Stocks?

A stock, often known as equity, represents partial ownership of the issuing company. Shares of stock entitle the owner to a proportionate share of the corporation’s assets and profits proportional to the number of shares owned. Shares of Apple, Microsoft, and Bank of America are examples of such shares. By purchasing shares in these firms, one acquires a little portion of the company’s equity, which entitles them to dividends.

What is a Stockbroker?

A stockbroker is a kind of financial expert that works on behalf of customers to carry out orders that are placed with the market. It is possible to hear the term “registered representative” (RR) or “investment adviser” while referring to a stockbroker.

What is a stockbrokerage firm?

There is a tendency to use the term “stockbrokers” to refer, more generally, both to brokerage businesses and broker-dealer corporations. The vast majority of stockbrokers are employed by brokerage firms, where they are responsible for handling transactions for a variety of individual and institutional clients. While the exact manner of payment might vary from company to employer, stockbrokers often get paid on a commission basis.

Stockbrokerage firms include cheap and cheerful brokerage services as well as full-service brokers. The vast majority of internet brokers are discount brokers, at least at their most fundamental levels of service, which means that transactions may either be done at no cost or for a very low fee that is predetermined. There are currently a lot of internet brokers that provide premium-level services at an increased price.

What is the difference between actual stock and CFD stock?

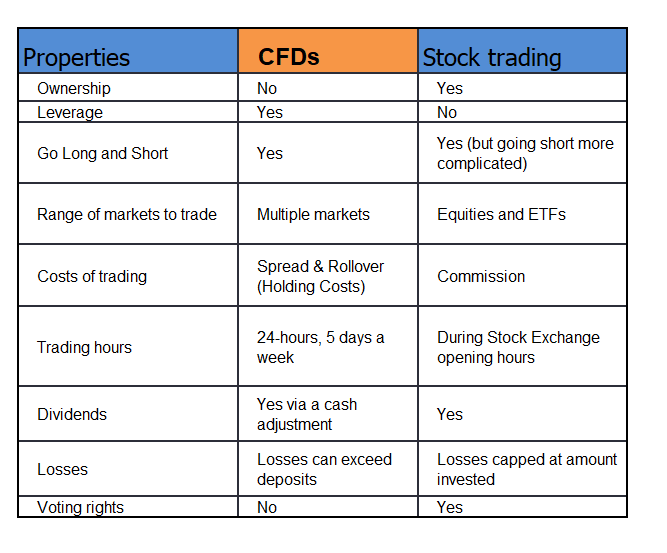

The primary distinctions between stocks and CFDs are leverage and ownership. When you purchase a stock, you become the owner of the shares. Investing in stocks is equivalent to acquiring a tiny interest in a business you believe in. By purchasing a stock, you pay the whole purchase price for each share.

CFD is an abbreviation for contract for difference. You may speculate on the price of a securities without owning the underlying asset via online CFD trading. The underlying asset of a contract for difference may be a stock, stock index, currency, commodity, or cryptocurrency. CFDs are leveraged, allowing you to join a trade with a reduced initial cash outlay.

Key points to consider before choosing a stock broker

Here are some of the key questions that you should be asking when looking to choose a broker. Below we will go in a lot more detail about the types of brokers we think are suitable

- How your broker make money?

- Does the broker suits your investing style?

- Is your broker regulated and is your money insured with them if they go down?

- Do they have vast range of stocks available especially the ones that you are interested in?

- What kind of trading platforms they have?

- Do they have decent support in terms of research?

- Do they have good customers service and what social media thinks of them?

- How much fee they charge you when you deposit or withdraw money from them?

Here are Top Stockbroker in 2023

Trading 212

What Is Trading 212?

Trading 212 was introduced in the United Kingdom in 2013 with the intention of making trading in a variety of assets simple and accessible to all. Located in London and authorised by the Financial Conduct Authority, the Trading 212 mobile app has risen to the top spot in the United Kingdom.

An attractive feature of Trading 212 Invest accounts is the ability to begin free trading in over 3,000 stocks, shares, and ETFs with as little as £1. Trading 212 offers zero commission fees, which is fantastic when compared to other trading platforms which can charge up to £12.5 per trade.

With Trading 212 Invest, shares can be purchased from the United Kingdom, Germany, the United States, the Netherlands, Switzerland, and Madrid, which is a fantastic selection.

The Trading212 ISA account enables UK residents to take advantage of everything the Invest Account has to offer, as well as the tax-free benefit. The United Kingdom permits merchants to invest up to £20,000 per tax year.

Benefits of Trading 212

Both Trading 212 Invest and ISA accounts permit the purchase and sale of fractional shares. Enable the Fractional Shares Indicator from the Trade Preferences section of your account’s settings menu.

If enabled, a little circle will display above any instrument that supports fractional shares.

Is Trading 212 safe

Trading 212 is a secure name and it is regulated by the FCA in the UK which is possibly one of the best regulation. By being regulated by the FCA, investors’ funds are insured up to £85K; this insurance kicks in if the company goes bust. In term of cyber tech and other online fishing threats, Trading 212 has a range of security measures that can kill bugs at initial stage and ensure that customers are protected

What is the product range on Trading 212?

Trading 212 CFD accounts give investors access to a wide range of asset classes, including stocks, forex, and commodities, and take measures to mitigate risk for traders, such as protecting accounts from going into the red with negative balance protection and letting them choose a price at which to cash out their gains or cut their losses.

How is the Trading 212 platform?

The online trading platform that Trading 212 developed in-house is one of the best. Its adaptability and search capabilities stand out as particularly useful features. In addition, you can access your results, interest charged and earned, and several other valuable pieces of information via alerts and notifications, as well as portfolio and fee reports.

The platform has a very user-friendly feel to it, and the layouts are self-explanatory. The features of purchasing shares and ensuring that the size of the trade is within your risk profile are extremely beneficial. Then the order tab on the platform makes the trade management quite useful.

Trading 212 deposit and withdrawal fees

In terms of non trading fees, Trading 212 does not charge account fees, inactivity fees, deposit fees, foreign exchange fees or withdrawal fees.

Trading 212 offers the following deposit and withdrawal options:

- Bank transfer

- Credit cards

- Debit cards

- Skill

- Paypal

- Dotpay

- Giropay

- Direct eBanking

There is a minimum deposit of only £1 which is great for investors who want to start slow.

Research Service

Trading 212’s research and tools are inconsistent. Their charting is one of the most thorough on the market, with over 60 technical indicators available to customers, but they don’t give any fundamental research or data on the goods they sell, and their news feed is sparse at best.

What Is Saxo?

Saxo Bank, founded in 1992, operates three regulated banks and is licenced in six tier-1 jurisdictions, making it a low-risk broker for trading stocks. Saxo Bank provides access to over 60,000 products, including (depending on your area) crypto derivatives, micro-futures, and currency options. SaxoTraderGo, the main platform of Saxo Bank, provides traders with everything they would need to navigate the market.

Saxo offers complex order types and account protection capabilities to manage risk seamlessly. It releases its daily average spread statistics not just across trading sessions, but also by order size, demonstrating its capacity to provide optimal execution at scale.

Is Saxo Bank Safe?

Saxo Bank is regarded as having a high level of credibility. It is privately held, operates a bank, and is authorised by six tier-1 regulators (high trust), one tier-2 regulator (medium trust), and zero tier-3 regulators (low trust) (low trust). Saxo Bank is licenced by the Australian Securities & Investments Commission (ASIC), the Securities Futures Commission (SFC), the Japanese Financial Services Authority (JFSA), the Monetary Authority of Singapore (MAS), the Swiss Financial Market Supervisory Authority (FINMA), and the Financial Conduct Authority (FCA). Gain knowledge about Trust Score.

Product Range on Saxo bank

More than 60,000 different symbols are available for trading with Saxo Bank, a multi-asset broker. Saxo Bank provides spot FX, FX options, non-deliverable forwards (NDFs), Contracts for Difference (CFDs), stocks, stock options, Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), futures, and 33,000 bonds in addition to electronically-traded markets covering practically every asset class (available only via phone).

Trading in cryptocurrency is possible via derivatives but not by trading the actual asset (e.g. buying Bitcoin). Retail traders from the U.K. corporation, as well as U.K. citizens, are not permitted to trade crypto CFDs.

Fees, deposit and withdrawal fees

Saxo Bank does not charge commissions, thus it profits from the spread. There is one exception: dealers who trade fewer than 50,000 units (half of a typical lot) each month are charged a $3 per side ticket price.

The average EUR/USD spreads for the Classic, Platinum, and VIP accounts were 0.8, 0.7, and 0.6 pips, respectively. Bottom line: the Platinum and VIP accounts have the greatest price among forex brokers, while the Classic account is closer to the industry average.

How is the Saxo trading platform and app?

SaxoTraderGO (web) and SaxoTraderPRO (desktop) are part of Saxo Bank’s premier trading package, which also includes TradingView, MultiCharts, and trading connection through API. In 2021, Saxo Bank’s proprietary platform suite included new capabilities such as crypto trading, a new Hot Topics page, and integrated webinars, among other more minor enhancements.

With 62 indicators, 20 drawing tools, and nine chart kinds to choose from, charts are diverse and powerful, and they sync between devices. The switch between instruments is simple, and display pertinent news and trading signals from Autochartist.

SaxoTraderPRO desktop: SaxoBank’s premier desktop platform is SaxoTraderPRO, which looks and feels similar to SaxoTraderGO. The functionality is comparable; however, the PRO platform has a broader range of professional trading tools. For example, PRO allows up to six monitors, streaming Level 2 order books, streaming time and sales, and algorithmic orders. It should be noted that extra data subscriptions are necessary to utilise technologies such as the streaming Level 2 order book, which is common business practise.

Research Review

Saxo Bank offers a diverse research offering across its websites and platforms, in a variety of formats (video, articles, podcasts and headlines). It provides in-house content, such as the daily updates published by its own analysts in Saxo Bank’s Market Analysis section, as well as third-party content such as the news headlines that stream from sources like Dow Jones, NewsEdge, and RanSquawk.

What is eToro?

Being a multi-asset investment platform, eToro allows users to invest in cryptocurrency, stocks, and ETFs all in one location, as well as perform a few other duties.

Is eToro Safe

In the United Kingdom, eToro is governed by the Financial Conduct Authority (FCA).

Although the Financial Services Compensation Scheme does not cover customers’ monies, the platform does keep them in a regulated bank account that is distinct from corporate funds and kept in trust.

This implies that if eToro goes bankrupt, no third party will be able to collect the funds.

The platform also protects consumers’ personal information using SSL encryption. This is an internet security technology that encodes data before it is delivered between computers. The information will be unreadable to anybody who manages to intercept it.

To add an extra degree of protection, you may log in using two-factor authentication. Two-factor authentication is enabled on all accounts. You must input a verification code provided to your cell phone by SMS.

Benefits of eToro

eToro provides intelligent portfolios. Smart Portfolios allow consumers to invest in a pre-selected assortment of assets with the goal of diversifying their holdings.

You can also use the platform’s CopyPortfolios to mechanically copy the portfolios of the platform’s most successful investors. If these ‘popular investors’ acquire enough copiers, they can supplement their investment profits with additional income.

You must spend at least £382 ($500) to access eToro’s Smart Portfolios and CopyPortfolios. You can only cash out if you close the whole portfolio.

Social investing is popular on the eToro platform; eToro connects investors with a social media-like news stream where news and tactics are debated.

What is the product range on eToro?

Users of eToro may invest in over 3,000 equities as well as a variety of ETFs with as little as £41 ($50). Both custom asset allocations and pre-constructed “Smart Portfolios” are available to you as investment options.

eToro is a major player in the cryptocurrency market, with 70 cryptoassets available.

Fees, deposit and withdrawal fees

While there is a fixed withdrawal charge of £3.83 ($5), you may purchase and sell on the marketplace without losing money.

This is especially beneficial for novice investors since there is no financial barrier to entry.

Yet, whether you’re buying or selling, investing in cryptoassets incurs a fixed cost of 1%.