Forex.com and AvaTrade are both long-standing and globally recognized forex and CFD brokers. Each brings distinct strengths to the table—Forex.com with its robust U.S. regulation and institutional-grade tools, and AvaTrade with its diverse platform options and strong presence in Europe, Asia, and the Middle East.

This comparison will walk through all the key factors—regulation, fees, platform access, and more—so traders can make the most informed decision in 2025.

Broker Review Contents

Company Overview

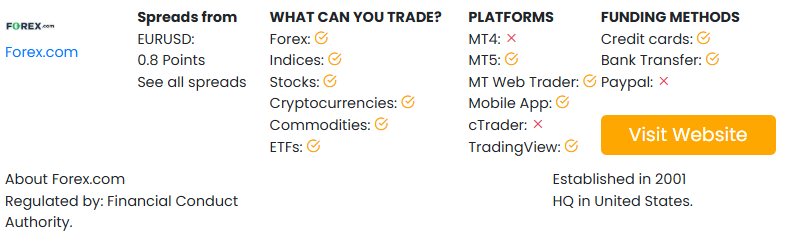

Forex.com, established in 2001, is part of the publicly traded StoneX Group (NASDAQ: SNEX), known for its global regulatory footprint and deep liquidity access.

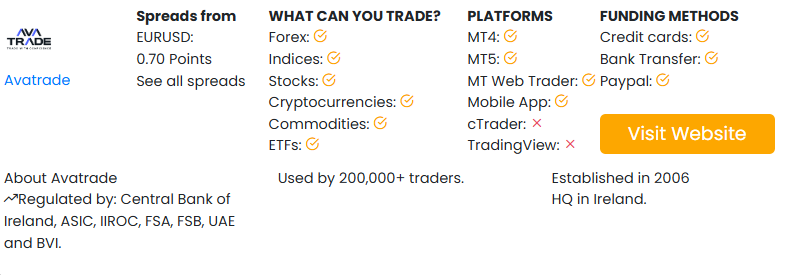

AvaTrade, launched in 2006 and headquartered in Dublin, Ireland, is an independent broker with multiple regional offices and localized support services.

| Feature | Forex.com | AvaTrade |

|---|---|---|

| Founded | 2001 | 2006 |

| Headquarters | USA | Ireland |

| Regulation | CFTC, FCA, ASIC, IIROC, CySEC | Central Bank of Ireland, ASIC, FSCA, FSA Japan, Abu Dhabi FSRA |

| Parent Company | StoneX Group (Public) | Independent |

| Active Clients | 300,000+ globally | 400,000+ globally |

Regulation and Licensing

Forex.com is regulated in several top-tier jurisdictions including:

- CFTC/NFA (USA)

- FCA (UK)

- ASIC (Australia)

- IIROC (Canada)

- CySEC (EU)

AvaTrade holds licenses from:

- Central Bank of Ireland

- ASIC (Australia)

- FSCA (South Africa)

- FSA (Japan)

- Abu Dhabi FSRA

Forex.com has a clear edge for traders in the U.S., while AvaTrade’s global coverage includes strong presence in Asia and Africa.

Trading Platforms

Forex.com supports:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Advanced Trading Platform (proprietary)

- TradingView integration

- WebTrader and mobile apps

AvaTrade offers:

- MetaTrader 4 and MetaTrader 5

- AvaTradeGO (proprietary app)

- AvaOptions (for FX options)

- WebTrader and AvaSocial (copy trading)

AvaTrade offers a wider variety of specialty platforms, especially for options trading and social copy trading. Forex.com offers better institutional-style tools and TradingView integration.

Instruments Offered

| Asset Class | Forex.com | AvaTrade |

|---|---|---|

| Forex Pairs | 80+ | 55+ |

| Indices | Yes | Yes |

| Commodities | Yes | Yes |

| Cryptocurrencies | Yes | Yes |

| Stocks (CFDs) | Yes | Yes |

| ETFs | Yes | Yes |

| Options | No | Yes (via AvaOptions) |

| Bonds | No | Yes |

AvaTrade provides more asset classes, including bonds and options. Forex.com focuses more on core markets with deeper liquidity.

Account Types and Minimum Deposit

Forex.com:

- Standard Account

- Commission Account (RAW spreads)

- DMA Account

- Swap-free Islamic Account

- Minimum deposit: $100

AvaTrade:

- Standard Account

- Islamic Account

- AvaOptions Account

- Copy trading account

- Minimum deposit: $100

Both brokers offer beginner-friendly minimums and swap-free options. AvaTrade’s inclusion of options trading and copy trading platforms adds versatility.

Fees and Spreads

Forex.com:

- Standard: From 1.0 pip

- RAW: From 0.2 pip + $5/lot

- No deposit fees

- Inactivity fee after 12 months

AvaTrade:

- Standard spreads from 0.9 pip

- No commissions on trades

- No deposit or withdrawal fees

- Inactivity fee after 3 months

AvaTrade keeps pricing simple with no commissions, while Forex.com provides more flexibility for high-frequency traders through tighter RAW spreads.

Leverage and Margin

| Region | Forex.com | AvaTrade |

|---|---|---|

| UK/EU (Retail) | 1:30 | 1:30 |

| U.S. Traders | 1:50 | Not accepted |

| Global Clients | Up to 1:200 | Up to 1:400 |

AvaTrade offers higher leverage globally (especially outside the EU), while Forex.com supports safer limits in heavily regulated markets.

Research and Education

Forex.com provides:

- Autochartist

- Trading Central

- Market analysis

- Webinars and news feeds

- Strategy optimizer and TradingView tools

AvaTrade includes:

- Daily market news

- SharpTrader Academy

- Economic calendars

- Webinars and eBooks

- Copy trading signals

Forex.com leans toward experienced traders with advanced tools, while AvaTrade focuses on a more holistic and beginner-friendly educational journey.

Mobile Trading

Forex.com mobile app features:

- Full asset access

- Advanced charting

- TradingView sync

- Fast execution

AvaTradeGO offers:

- User-friendly dashboard

- Trade management

- Market trends and alerts

- AvaProtect for risk control

Both brokers offer strong mobile apps, but AvaTradeGO appeals more to new traders with its simplified layout and features like AvaProtect.

Customer Support

Forex.com:

- 24/5 global support

- Phone, email, and live chat

- Localized service in multiple languages

AvaTrade:

- 24/5 multilingual support

- Phone, live chat, and email

- Regional offices for localized assistance

Both provide strong support, but AvaTrade offers a slightly broader multilingual setup in more emerging regions.

Quick Comparison Table

| Feature | Forex.com | AvaTrade |

|---|---|---|

| Regulation | US, UK, CA, EU, AU | EU, AU, JP, UAE, ZA |

| Platforms | MT4, MT5, TradingView, DMA | MT4, MT5, AvaTradeGO, AvaOptions |

| Minimum Deposit | $100 | $100 |

| Spread (min) | 0.2 pip + commission | 0.9 pip (no commission) |

| Leverage (Global) | Up to 1:200 | Up to 1:400 |

| Cryptocurrencies | Yes | Yes |

| Copy/Social Trading | No | Yes |

| Options Trading | No | Yes |

| Ideal For | Institutional & global traders | Options, social & crypto traders |

Forex.com is ideal for traders who want powerful research tools, institutional-style execution, and access to global markets under top-tier regulation. It’s especially suited for traders in the U.S. and other regulated environments.

AvaTrade caters to traders who prefer simplicity, multi-platform versatility, and a broader variety of instruments including FX options and copy trading. It is a strong choice for newer traders and those looking to diversify beyond traditional assets.