In a competitive brokerage landscape, Forex.com and Easy Markets serve different ends of the trading spectrum. Forex.com is a globally regulated broker backed by the publicly traded StoneX Group, while Easy Markets focuses on fixed-spread simplicity, trader protection tools, and beginner-friendly platforms.

This in-depth guide explores their trading environments, fees, account types, and technology so you can choose the broker that suits your trading goals in 2025.

Broker Review Contents

Company Overview

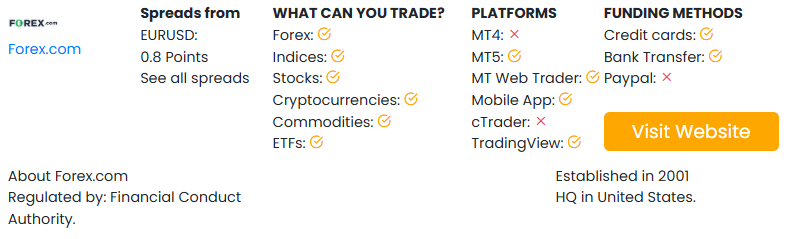

Forex.com was established in 2001 and is known for its institutional-grade infrastructure, wide asset range, and robust regulatory standing.

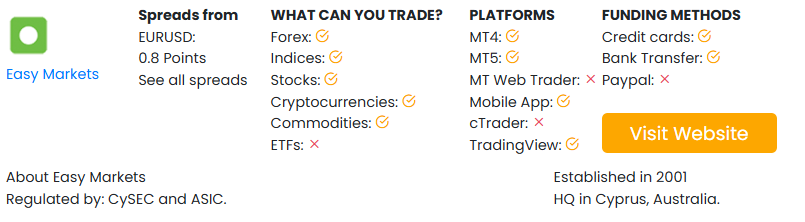

Easy Markets was founded in 2001 as well and positions itself as a beginner-friendly broker with fixed spreads, guaranteed stop loss, and no slippage execution.

| Feature | Forex.com | Easy Markets |

|---|---|---|

| Founded | 2001 | 2001 |

| Headquarters | USA | Cyprus |

| Regulatory Oversight | US, UK, AU, CA, EU | EU, Australia, Seychelles |

| Parent Company | StoneX Group Inc (NASDAQ: SNEX) | Blue Capital Markets Group |

Regulatory Framework and Security

Forex.com is regulated by:

- CFTC/NFA (USA)

- FCA (UK)

- ASIC (Australia)

- IIROC (Canada)

- CySEC (Europe)

Easy Markets holds licenses from:

- CySEC (Europe)

- ASIC (Australia)

- FSA (Seychelles)

While both are regulated, Forex.com maintains a more robust, globally recognized set of licenses. Easy Markets, however, provides good protection for retail EU and APAC clients.

Platforms and Execution

Forex.com supports:

- MetaTrader 4 and 5

- Advanced Trading Platform (desktop)

- TradingView integration

- WebTrader

- Mobile app

Easy Markets offers:

- Proprietary Web and Mobile platform

- MetaTrader 4

- TradingView (recent integration)

- Deal Cancellation, Freeze Rate, and Guaranteed SL features

Easy Markets focuses on simplicity with innovative tools like DealCancellation, while Forex.com is built for both casual and advanced traders with multiple platform options and deeper integration.

Trading Instruments

| Asset Type | Forex.com | Easy Markets |

|---|---|---|

| Forex | 80+ pairs | 60+ pairs |

| Indices | Yes | Yes |

| Commodities | Yes | Yes |

| Metals | Yes | Yes |

| Stocks (CFDs) | Yes | Yes |

| ETFs | Yes (CFDs) | No |

| Cryptocurrencies | Yes | Yes |

| Options | No | Yes (Vanilla Options) |

Forex.com wins in diversity and depth, while Easy Markets appeals to users interested in options trading and simplified forex pairs.

Account Types and Deposit Requirements

Forex.com offers:

- Standard Account

- Commission (RAW Spread)

- Direct Market Access (DMA)

- Swap-Free (Islamic)

Easy Markets provides:

- Standard Account (fixed spread)

- VIP Account (lower spreads)

- MT4 Account

- Islamic Account

Minimum deposits:

- Forex.com: $100

- Easy Markets: $25 (standard), $250 (VIP)

Easy Markets provides a lower entry barrier and maintains fixed spreads, which can be appealing to new traders who want predictability.

Spreads, Fees, and Commissions

Forex.com:

- Standard spreads: From 1.0 pip

- RAW spread account: From 0.2 pip + $5/lot

- DMA pricing available

- Inactivity fee after 12 months

Easy Markets:

- Fixed spreads starting at 1.8 pips

- No commissions

- No deposit/withdrawal or inactivity fees

- Unique trader protection tools may impact cost structure

Forex.com’s RAW and DMA accounts are more suitable for tight-spread or institutional traders. Easy Markets appeals to those who prioritize transparency and fee simplicity.

Leverage and Margin

| Region | Forex.com | Easy Markets |

|---|---|---|

| UK/EU (Retail) | 1:30 | 1:30 |

| US | 1:50 | Not available |

| Offshore | Up to 1:200 | Up to 1:400 |

Easy Markets offers higher offshore leverage for global traders. Forex.com remains more conservative but legally compliant in high-regulation zones like the U.S. and UK.

Tools, Research, and Education

Forex.com delivers:

- Autochartist

- Trading Central

- TradingView integration

- Market analysis, webinars, and eBooks

Easy Markets provides:

- DealCancellation (cancel trade within 1 hour)

- Freeze Rate (lock in price)

- Economic indicators

- Basic educational content

Forex.com is more equipped for intermediate and advanced traders looking for technical analysis and AI-driven forecasts. Easy Markets is ideal for traders who want protection features and simplicity.

Mobile and Web Trading

Forex.com:

- Mobile apps available on iOS and Android

- Charting, trade execution, and price alerts

- Full TradingView integration

Easy Markets:

- Easy-to-navigate proprietary app

- Integrated DealCancellation and Freeze Rate

- Also supports MT4 mobile

Both provide excellent mobile trading environments. Forex.com leans more professional, while Easy Markets emphasizes accessibility and safety for newer users.

Customer Support

Forex.com:

- 24/5 support

- Email, phone, and live chat

- Local support offices

Easy Markets:

- 24/5 multilingual support

- Live chat, phone, email

- Personal account managers for VIP users

Both offer reliable customer service, but Easy Markets has the edge in onboarding and hand-holding for less experienced traders.

Feature Comparison Table

| Feature | Forex.com | Easy Markets |

|---|---|---|

| Regulation | US, UK, AU, CA, EU | EU, AU, Seychelles |

| Platforms | MT4, MT5, TradingView, Web | MT4, Web, TradingView |

| Fixed Spreads | No | Yes |

| Minimum Deposit | $100 | $25–$250 |

| Leverage (offshore) | Up to 1:200 | Up to 1:400 |

| Unique Tools | Autochartist, DMA, TradingView | DealCancellation, Freeze Rate |

| Commissions | Yes (RAW/DMA accounts) | No |

| Best For | Advanced global traders | New/intermediate EU/APAC traders |

Which one is the best?

Forex.com is designed for traders who want a powerful, globally regulated broker with access to institutional-grade execution, raw pricing, and advanced analytics. It’s an ideal platform for professional and semi-professional traders in regulated markets.

Easy Markets is best suited for newer or casual traders who want transparent pricing, strong account protection tools, and a no-stress learning environment. Its fixed spreads, no slippage policy, and beginner features help reduce surprises in volatile conditions.