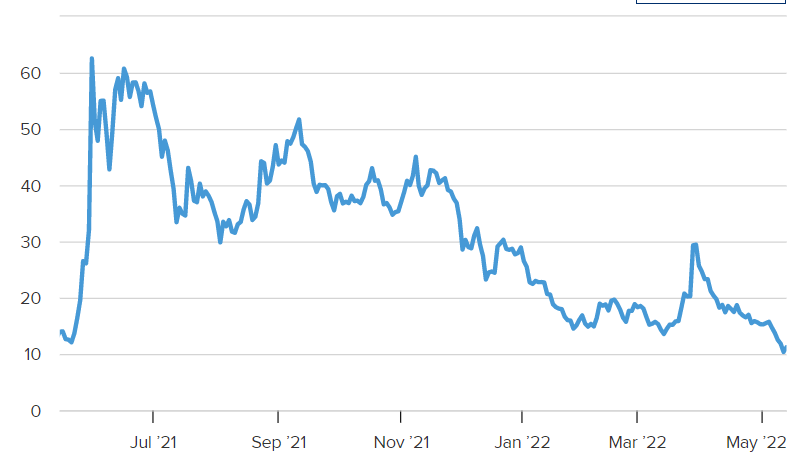

GameStop’s stock soared more than 301% at one stage and was repeatedly suspended due to the fluctuation. Earlier last year, a group of individual investors used internet chatrooms to arrange transactions in GameStop and AMC, causing large short nudges in both companies. Despite the huge swings on Thursday, the equities are still considerably below their highs from the first half of 2021.

Stocks Pump of GameStop and AMC

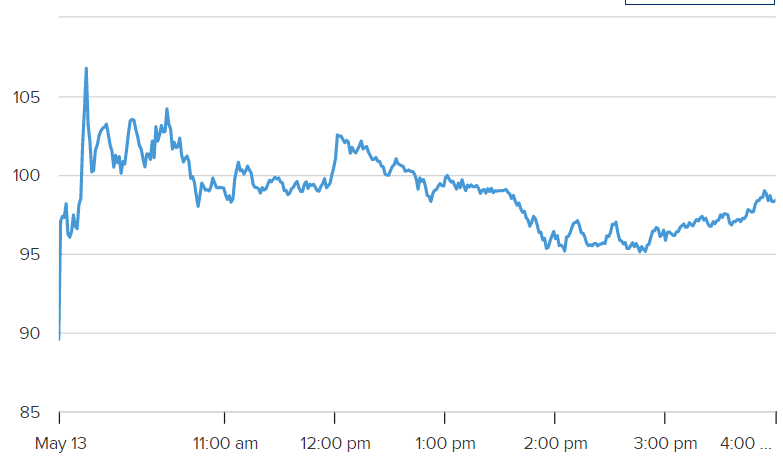

On Thursday, shares in two meme stocks jumped, adding an unexpected twist to a market that had been falling in volatile activity for more than a month. GameStop soared more than 31% and was repeatedly stopped for volatility before closing the day with a gain of 10.2%. The stock of movie theater company AMC Entertainment increased by more than 8.3%, down from a peak of more than 20.02 percent.

Last year Analysis of GameStop and AMC

Early last year, individual investors organized transactions in internet chatrooms to produce significant squeezes in GameStop and AMC. Several fund managers engaged in these speculations suffered greatly as a result of the spectacular surges.

GameStop and AMC market Analysis

Because the BMV values have plummeted, it may be simpler for a few brokerage firms or even a single huge fund to initiate a fresh short squeeze. Likewise, AMC and GameStop sold shares and raised funds in 2021, reaping the benefits of their momentarily inflated share prices. AMC CEO Adam Aron has made efforts to court regular investors, adding shareholder rewards at physical theaters.