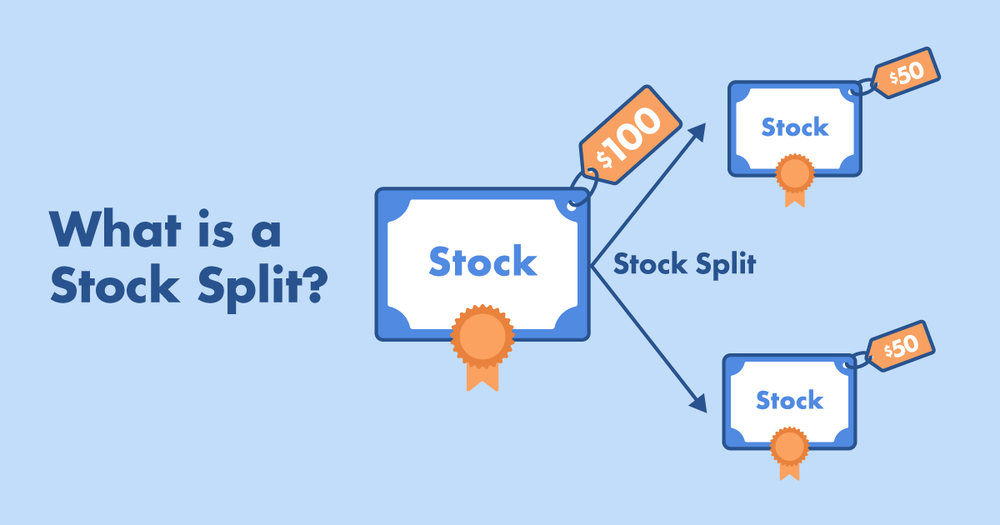

A stock split increases the number of shares in a corporation by dividing the original number of shares in the company. Raising the liquidity of a firm is a common goal of stock splits, which allow investors to purchase and sell shares more readily. It is possible to decrease a share’s value and increase its supply by dividing a company’s stock into several lots. This implies that current owners of that company’s stock will get an extra share for each and every share they already own.

Look for the following things when a stock splits

Cheap share price brings higher level of demand for a stock which was previously valued at a higher price. For instance, Apple has done stock splits several times to keep the share price low so that it can continue to bring more sharesholders. If the stock price is extremely high, not may traders can buy or sell that stock. It is in the interest of a company that it has more shareholders

Is a stock split worth taking advantage of?

As tempting as it may be to purchase a high-priced stock at a discount. Enthusiastic buyers must make absolutely sure that the stock corresponds with their total investment objectives. Unless you’ve had Amazon stock in your portfolio for a long time. You shouldn’t go all in merely to claim you own it. Investing in numerous types of investments (equities, stocks, property investments, etc.) requires full risk assesment.