With countless forex brokers available, two consistently top the charts among both beginner and experienced traders: Forex.com and XM Group. Both firms offer global regulatory compliance, extensive trading instruments, and robust technology. But which broker provides the ideal trading environment for your goals in 2025?

This breakdown dives deep into every angle — from platforms and pricing to regulation and education — to help you decide which of these heavyweights is best for your trading strategy.

Broker Review Contents

Broker Overview

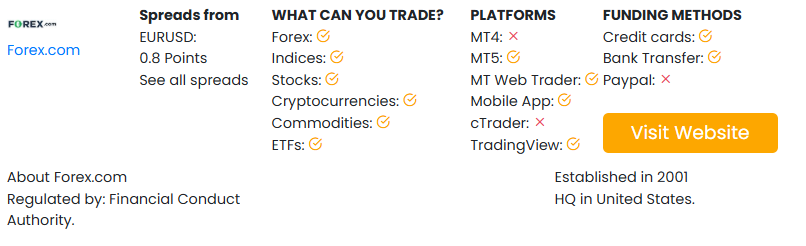

Forex.com, part of StoneX Group (NASDAQ: SNEX), is a long-established broker founded in 2001. It has built a solid global presence and is well-regarded for its transparency and powerful trading platforms.

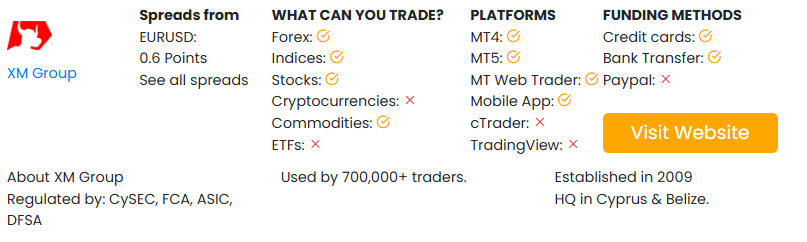

XM Group, launched in 2009, is a global forex and CFD broker known for its flexible trading conditions, multiple account types, and educational focus. It has gained popularity among traders in Asia, the Middle East, and Africa.

| Feature | Forex.com | XM Group |

|---|---|---|

| Founded | 2001 | 2009 |

| Headquarters | USA | Belize |

| Regulatory Oversight | CFTC, FCA, ASIC, IIROC, CySEC | CySEC, ASIC, DFSA, FSC |

| Client Base | 300,000+ | 5,000,000+ |

| Focus | Global retail and institutional | Retail trading and education |

Regulation and Security

Forex.com is regulated by top-tier financial bodies:

- CFTC and NFA (USA)

- FCA (UK)

- ASIC (Australia)

- IIROC (Canada)

- CySEC (Cyprus)

XM Group holds regulation from:

- ASIC (Australia)

- CySEC (Cyprus)

- DFSA (Dubai)

- FSC (Belize, offshore)

Forex.com is more widely regulated in high-trust financial jurisdictions. XM covers both tier-1 and tier-2 regulators, giving it flexibility in emerging markets.

Trading Platforms

Forex.com provides:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Advanced Trading Platform

- TradingView integration

- WebTrader

- Mobile app

XM Group offers:

- MetaTrader 4 and MetaTrader 5

- WebTrader

- XM Mobile App

- No proprietary platform

Forex.com stands out with its integration of TradingView and its advanced desktop platform. XM focuses on a clean MT4/MT5 experience with optimized infrastructure for reliability.

Tradable Instruments

| Asset Type | Forex.com | XM Group |

|---|---|---|

| Forex Pairs | 80+ | 55+ |

| Indices | Yes | Yes |

| Commodities | Yes | Yes |

| Metals | Yes | Yes |

| Stocks (CFDs) | Yes | Yes |

| Cryptocurrencies | Yes | Yes |

| ETFs | Yes (CFDs) | No |

| Futures | No | No |

Forex.com provides a broader range of trading instruments, particularly in ETFs and currency pairs. XM, while slightly more limited, still offers comprehensive access to the most popular markets.

Account Types and Minimum Deposits

Forex.com accounts:

- Standard

- Commission (RAW)

- DMA (Direct Market Access)

- Islamic (swap-free)

XM Group accounts:

- Micro Account

- Standard Account

- Ultra-Low Account

- Shares Account

- Islamic (swap-free)

Minimum deposit:

- Forex.com: $100

- XM Group: $5 (Micro account)

XM provides a more accessible entry point for beginners with low minimums, while Forex.com offers institutional-style accounts for high-volume traders.

Spreads and Pricing

Forex.com:

- Standard spreads: From 1.0 pip

- RAW account: From 0.2 pip + $5/lot

- DMA pricing available

- No deposit fees

XM Group:

- Micro & Standard accounts: From 1.6 pips

- Ultra-Low account: From 0.6 pips

- No commissions (except Shares account)

- No deposit or withdrawal fees

XM is more beginner-friendly in its fee structure, while Forex.com provides pro-level pricing flexibility via its DMA and RAW accounts.

Leverage Options

| Region | Forex.com | XM Group |

|---|---|---|

| USA Clients | 1:50 | Not accepted |

| EU/UK Retail | 1:30 | 1:30 |

| Offshore | Up to 1:200 | Up to 1:1000 |

XM offers ultra-high leverage (1:1000) for offshore clients, appealing to aggressive traders. Forex.com remains conservative, which may suit those in tightly regulated countries.

Tools, Education & Research

Forex.com includes:

- Autochartist

- Trading Central

- Integrated TradingView charts

- Market insights and daily updates

- Webinars and eBooks

XM Group offers:

- Live daily webinars in multiple languages

- Trading signals

- Economic calendar

- Video tutorials and Forex seminars

- MT4/MT5 add-ons

XM leads in multilingual education and beginner resources, while Forex.com appeals to more advanced traders seeking institutional tools and integrations.

Mobile Trading Experience

Forex.com:

- Modern mobile app with real-time charting

- TradingView access

- One-touch trading and custom alerts

XM Group:

- XM App (user-friendly)

- MT4/MT5 mobile support

- Account management and full trading functions

Both platforms perform well on mobile, but Forex.com’s integration with third-party analytics offers more depth.

Customer Support

Forex.com:

- 24/5 live chat, phone, and email

- Global multilingual support

- Fast KYC and onboarding

XM Group:

- 24/5 support in over 25 languages

- Live chat and ticket system

- Strong regional team presence

XM excels in multilingual reach, while Forex.com is slightly faster with onboarding and response time.

Quick Comparison Table

| Feature | Forex.com | XM Group |

|---|---|---|

| Regulation | US, UK, CA, EU, AU | EU, AU, MENA, Offshore |

| Minimum Deposit | $100 | $5 |

| Spreads | From 0.2 pip (RAW) | From 0.6 pip (Ultra-Low) |

| Max Leverage | Up to 1:200 | Up to 1:1000 |

| ETF Trading | Yes | No |

| Platforms | MT4/MT5 + TradingView | MT4/MT5 only |

| Tools & Education | Institutional-grade | Beginner-friendly, multilingual |

| Ideal For | Advanced and pro traders | New and global retail traders |

Forex.com offers a more institutional experience with access to powerful tools, broader regulation, and deeper market coverage. It’s an excellent choice for traders in regulated markets or those looking for DMA access.

XM Group makes a compelling case for newer traders or those in emerging markets. With lower deposit thresholds, high leverage options, and an emphasis on education, it’s a gateway broker for many.