Forex.com and Pepperstone are among the top-rated brokers in the forex and CFD trading world. Each broker brings unique advantages in terms of regulation, spreads, trading tools, and market access. If you’re a trader evaluating which broker aligns better with your goals in 2025, this comprehensive analysis will help you make a confident decision.

Broker Review Contents

Company Background

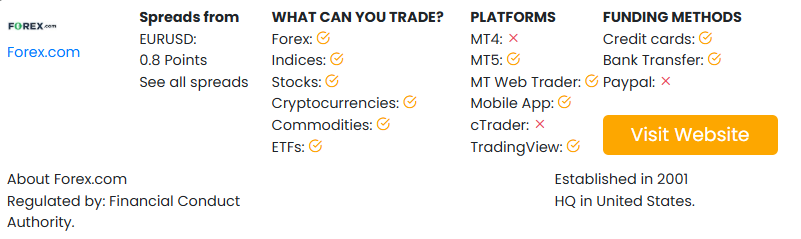

Forex.com has been serving global traders since 2001 and operates under the financial umbrella of StoneX Group Inc., a publicly traded financial giant in the U.S.

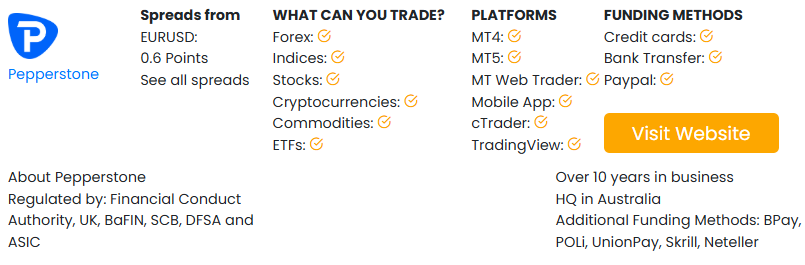

Pepperstone, founded in 2010 in Melbourne, Australia, quickly gained global traction due to its razor-sharp spreads and fast execution infrastructure.

| Feature | Forex.com | Pepperstone |

|---|---|---|

| Founded | 2001 | 2010 |

| Headquarters | USA | Australia |

| Regulation | CFTC, FCA, ASIC, IIROC, CySEC | ASIC, FCA, DFSA, BaFin, CMA, CySEC |

| Parent Company | StoneX Group (NASDAQ: SNEX) | Independent |

| Clients Served | 300,000+ globally | 400,000+ globally |

Regulation and Trust

Forex.com is regulated by top-tier financial watchdogs including:

- CFTC/NFA (USA)

- FCA (UK)

- ASIC (Australia)

- IIROC (Canada)

- CySEC (Cyprus)

Pepperstone is also heavily regulated, with licenses from:

- ASIC (Australia)

- FCA (UK)

- DFSA (Dubai)

- BaFin (Germany)

- CMA (Kenya)

- CySEC (Cyprus)

Both brokers offer solid regulatory protections. Forex.com has U.S. regulatory coverage, while Pepperstone extends its reach into the Middle East and Africa.

Platforms Offered

Forex.com supports:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Advanced Trading Platform (Desktop)

- WebTrader

- TradingView integration

- Mobile apps

Pepperstone provides:

- MetaTrader 4 and MetaTrader 5

- cTrader

- TradingView

- Capitalise.ai (no-code automation)

- Mobile and web platforms

While Forex.com is ideal for traders who want advanced analytics, Pepperstone has the edge in automation with Capitalise.ai and additional platform variety with cTrader.

Tradable Instruments

| Instrument Type | Forex.com | Pepperstone |

|---|---|---|

| Forex Pairs | 80+ | 60+ |

| Indices | Yes | Yes |

| Commodities | Yes | Yes |

| Stocks (CFDs) | Yes | Yes |

| ETFs | Yes (CFDs) | Yes (limited CFDs) |

| Cryptocurrencies | Yes | Yes |

| Bonds | No | No |

Forex.com offers slightly broader exposure with more forex pairs and ETF CFDs, while Pepperstone covers all essentials with a strong crypto offering.

Account Types and Fees

Forex.com:

- Standard Account

- Commission Account (RAW spreads)

- DMA Account

- Islamic Account

- Minimum deposit: $100

Pepperstone:

- Standard Account

- Razor Account (RAW spreads)

- Islamic Account

- Minimum deposit: $0 (recommended $200)

| Fee Type | Forex.com | Pepperstone |

|---|---|---|

| Standard Spread | From 1.0 pip | From 1.0 pip |

| RAW Spread | From 0.2 pip + $5/lot | From 0.0 pip + $3.5/lot |

| Commissions | Yes (RAW & DMA accounts) | Yes (Razor account) |

| Deposit/Withdrawal Fee | None | None |

| Inactivity Fee | Yes (after 12 months) | Yes (after 6 months) |

Pepperstone stands out with ultra-low RAW spreads and no minimum deposit, while Forex.com offers more account variety and DMA access for professionals.

Leverage and Margin

| Region | Forex.com | Pepperstone |

|---|---|---|

| UK/EU Retail | 1:30 | 1:30 |

| U.S. Clients | 1:50 | Not accepted |

| Global Clients | Up to 1:200 | Up to 1:500 |

Pepperstone allows higher leverage globally, which is attractive to aggressive traders outside strict jurisdictions. Forex.com maintains safer leverage standards with broader compliance coverage.

Research and Tools

Forex.com provides:

- Autochartist

- Trading Central

- Strategy optimizer

- Webinars and market insights

- Integrated TradingView

Pepperstone offers:

- Capitalise.ai (no-code strategy automation)

- TradingView integration

- Economic calendar

- Smart Trader Tools (MT4 add-ons)

- Webinars and trading guides

Forex.com leads with institutional research tools, while Pepperstone caters well to automation and customization enthusiasts.

Mobile Trading Experience

Forex.com’s mobile app offers:

- Fast execution

- Customizable layouts

- Real-time news and alerts

- TradingView sync

Pepperstone’s mobile app delivers:

- Seamless MT4/MT5 and cTrader access

- Integrated Capitalise.ai

- Clean interface for fast execution

Both provide excellent mobile platforms, with Pepperstone standing out in no-code automation and Forex.com in advanced analytics.

Customer Support

Forex.com:

- 24/5 multilingual support

- Phone, email, and live chat

- U.S.-based and international service

Pepperstone:

- 24/5 support

- Multilingual live chat and email

- Dedicated account managers for higher-tier clients

Both brokers offer responsive and professional customer support. Pepperstone adds more value for traders looking for regional personalization.

Comparison Summary Table

| Feature | Forex.com | Pepperstone |

|---|---|---|

| Regulation | US, UK, CA, EU, AU | AU, UK, UAE, Kenya, Cyprus, Germany |

| Platforms | MT4, MT5, TradingView, DMA | MT4, MT5, cTrader, Capitalise.ai |

| Minimum Deposit | $100 | $0 (Recommended $200) |

| Spreads (RAW) | From 0.2 pip + $5/lot | From 0.0 pip + $3.5/lot |

| Leverage (Global) | Up to 1:200 | Up to 1:500 |

| ETFs and Bonds | Yes (ETFs) | Yes (limited ETFs) |

| Copy/Social Trading | No | Yes (via third-party integrations) |

| Ideal For | Pro traders, U.S. clients | Scalpers, automation & global traders |

Forex.com is a strong choice for traders seeking tight regulatory compliance, professional tools, and U.S. market access. Its broad market coverage and analytical tools make it an excellent fit for institutional-style traders.

Pepperstone is best suited for traders who want faster execution, better spreads, and automation tools. It’s also more accessible for global traders outside the U.S., thanks to higher leverage and no minimum deposit requirements.