In the evolving world of forex trading, not all brokers are built the same. While Forex.com is a household name trusted globally, ATC Brokers appeals to a more specialized group of traders seeking direct access and transparent pricing. This analysis breaks down how each broker compares in terms of regulation, platforms, accounts, pricing, and more to help you make a fully informed decision.

Broker Review Contents

Broker Overview

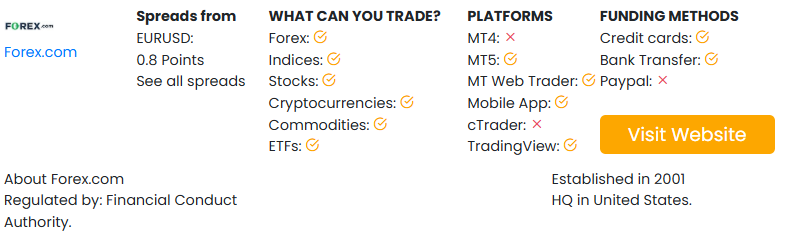

Forex.com was established in 2001 and is operated by GAIN Capital, under the StoneX Group (NASDAQ: SNEX). It serves traders globally with a wide array of asset classes and platforms.

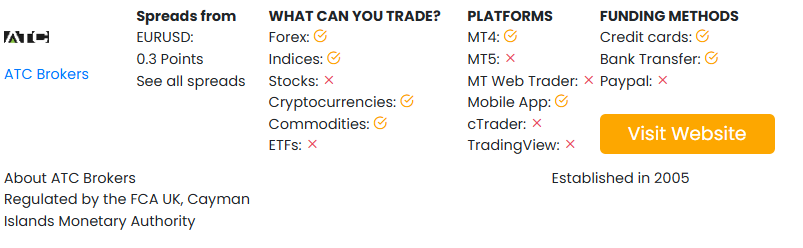

ATC Brokers, founded in 2005, is a boutique broker known for its ECN (Electronic Communication Network) model, offering raw spreads and direct market access for experienced traders.

| Feature | Forex.com | ATC Brokers |

|---|---|---|

| Founded | 2001 | 2005 |

| Headquarters | USA | USA / Cayman Islands |

| Regulatory Oversight | CFTC, FCA, ASIC, IIROC, CySEC | CFTC (USA), CIMA (Cayman) |

| Focus | Retail and institutional trading | ECN trading for professionals |

Regulation and Trust

Forex.com is heavily regulated across multiple jurisdictions:

- CFTC and NFA (USA)

- FCA (UK)

- ASIC (Australia)

- IIROC (Canada)

- CySEC (Europe)

ATC Brokers is regulated by:

- CFTC (USA) for domestic clients

- CIMA (Cayman Islands) for offshore clients

Both are regulated entities, but Forex.com operates under more licenses globally, making it more accessible and trusted across different client segments.

Platform Technology

Forex.com offers:

- MetaTrader 4 and 5

- Proprietary Advanced Trading Platform

- WebTrader

- Mobile app

- TradingView integration

ATC Brokers provides:

- MetaTrader 4 (only)

- Institutional-grade ECN bridge technology

- Custom MT4 add-ons

- FIX API connectivity (for algorithmic traders)

ATC Brokers focuses purely on MT4 with deep liquidity connections and an ECN model. Forex.com provides multiple platforms with more built-in tools for analysis and education.

Account Types

Forex.com offers:

- Standard (spread-based)

- Commission (RAW)

- DMA (Direct Market Access)

- Islamic (swap-free)

ATC Brokers offers:

- ECN Live Account

- Demo Account

- Islamic Account (available upon request)

Forex.com offers more flexibility for all trader levels, while ATC Brokers is geared specifically toward advanced ECN traders.

Instruments and Market Access

| Asset Type | Forex.com | ATC Brokers |

|---|---|---|

| Forex Pairs | 80+ | 40+ |

| Indices | Yes | No |

| Commodities | Yes | No |

| Metals | Yes | Yes |

| Stocks (CFDs) | Yes | No |

| Cryptocurrencies | Yes | No |

| ETFs | Yes | No |

Forex.com clearly has broader asset availability, making it a better option for traders looking to diversify beyond just currency pairs and metals.

Spreads and Fees

Forex.com:

- Standard spreads: From 1.0 pip

- RAW spread account: From 0.2 pips + $5/lot

- DMA pricing available

- Inactivity fee after 12 months

ATC Brokers:

- Spreads: From 0.0 pips (ECN)

- Commission: $6/lot round trip

- No markup on spreads

- No deposit/withdrawal fees on most methods

ATC Brokers is highly competitive for tight-spread scalpers and algorithmic traders, while Forex.com offers more account variety and user-friendly pricing for different skill levels.

Leverage and Margin

| Region | Forex.com | ATC Brokers |

|---|---|---|

| US Retail | 1:50 | 1:50 |

| Offshore | Up to 1:200 | Up to 1:200 |

Both brokers comply with regulated leverage in the U.S. and offer increased leverage options offshore. ATC focuses on maintaining margin transparency within its ECN model.

Tools and Analytics

Forex.com includes:

- Autochartist

- Trading Central

- Strategy optimizer

- Market commentary and webinars

- Integrated TradingView charts

ATC Brokers includes:

- FIX API for algo traders

- MT4 plugins and VPS hosting

- No built-in educational tools

- Raw price feed access

Forex.com is better for beginner and intermediate traders who need educational tools. ATC Brokers caters to advanced traders who already have their own systems and want raw access.

Mobile Trading Experience

Forex.com:

- Native app for iOS and Android

- Price alerts, news, full trading access

- Syncs with TradingView and MT4/5

ATC Brokers:

- MT4 mobile app only

- Real-time order execution

- No proprietary mobile tools

Forex.com delivers a more robust mobile experience for a wide range of users. ATC Brokers keeps it simple and functional.

Customer Support

Forex.com:

- 24/5 support

- Live chat, phone, email

- Multilingual help

- Local office access in many countries

ATC Brokers:

- 24/5 support

- Email and phone

- Fast response times

- Smaller support footprint

Forex.com is better suited for global users needing multilingual support. ATC Brokers provides faster, personalized help for a smaller client base.

Comparison Table

| Feature | Forex.com | ATC Brokers |

|---|---|---|

| Regulation | CFTC, FCA, ASIC, CySEC | CFTC, CIMA |

| Platforms | MT4, MT5, TradingView, WebTrader | MT4 + ECN bridge |

| Minimum Deposit | $100 | $5,000 (recommended) |

| Asset Range | Wide (forex, stocks, crypto, etc) | Limited (forex, metals) |

| Commissions | From $5/lot (RAW) | $6/lot (ECN only) |

| Spreads | From 0.2 pips | From 0.0 pips |

| Tools & Education | Autochartist, webinars, TradingView | VPS, FIX API, MT4 plug-ins |

| Ideal For | Beginner to pro traders | Professional ECN traders |

Forex.com is a better choice for most traders, especially those who value education, regulatory protection, and multiple platform options. It’s ideal for traders in North America, the UK, and regulated markets.

ATC Brokers is tailored for advanced, high-volume, or algorithmic traders who want pure ECN execution, raw spreads, and FIX API access. Its minimalist approach works best for pros who already have the tools and strategies in place.