A Comprehensive Legal, Safety, and Risk-Focused Guide for Responsible Forex Trading

Forex trading has become one of the most actively discussed financial activities in South Africa. With advanced internet access, a strong banking sector, and a well-established financial services industry, South Africa offers one of the most structured environments for retail forex trading on the African continent.

However, despite its accessibility, forex trading remains a high-risk financial activity that requires careful planning, regulatory awareness, and disciplined risk management. Many traders enter the market with unrealistic expectations or incomplete information, which often leads to avoidable losses.

This in-depth guide is designed to provide South African traders with a clear, accurate, and responsible understanding of forex trading in 2026. Instead of focusing on hype or aggressive promotion, this page prioritizes legality, safety, risk awareness, and long-term sustainability.

Understanding Forex Trading in a South African Context

Forex trading involves the exchange of one currency for another, typically for speculative or hedging purposes. Traders aim to profit from changes in exchange rates between currency pairs.

In South Africa, forex trading is widely accessible through online platforms, but accessibility does not remove responsibility. Trading currencies exposes participants to market volatility, leverage risks, and financial uncertainty. Success depends not on luck, but on knowledge, discipline, and preparation.

South Africa stands apart from many countries because forex trading operates within a defined legal and regulatory framework, offering traders clearer guidance and higher protection when compared to jurisdictions where forex exists in regulatory grey zones.

Is Forex Trading Legal in South Africa in 2026?

Yes. Forex trading is legal in South Africa.

Retail traders are permitted to trade forex as long as they use authorized brokers and comply with applicable financial and exchange control regulations. South Africa recognizes forex trading as a legitimate financial activity when conducted responsibly and within regulatory boundaries.

The regulatory environment aims to protect traders from fraud, excessive risk, and misleading practices while maintaining the integrity of the financial system.

South Africa’s Regulatory Framework for Forex Trading

South Africa has one of the most robust financial regulatory systems in Africa. Regulatory oversight focuses on market transparency, investor protection, and fair trading practices.

Broker Authorization and Oversight

Forex brokers operating locally must meet strict authorization requirements. Authorization ensures that brokers adhere to professional standards, maintain operational integrity, and provide transparent services to clients.

Regulated brokers are expected to:

Operate fairly and honestly

Provide clear risk disclosures

Avoid misleading marketing

Handle client funds responsibly

This regulatory structure gives South African traders a level of protection not always available in other regions.

Why South Africa Is Considered a Safer Forex Market

Several factors contribute to South Africa’s reputation as a safer environment for forex trading:

Established regulatory oversight

Clear legal recognition of retail forex trading

Strong banking infrastructure

Transparent compliance requirements

Formal dispute resolution mechanisms

These factors help reduce systemic risk and provide traders with clearer expectations when entering the forex market.

How Forex Trading in South Africa Has Evolved Over Time

Forex trading in South Africa has matured significantly over the past decade.

Stronger Focus on Investor Protection

There is now greater emphasis on protecting retail traders from excessive risk. Brokers are expected to present realistic expectations and discourage irresponsible trading behavior.

Improved Compliance Standards

Stricter verification procedures, reporting obligations, and anti-money laundering measures have increased accountability across the industry.

Technology and Platform Improvements

Trading platforms have become faster, more stable, and more user-friendly. Mobile trading, advanced charting tools, and automated systems are now standard.

More Informed Trading Community

South African traders are increasingly educated and cautious. Many now prioritize strategy development, risk management, and long-term performance rather than short-term speculation.

Choosing a Forex Broker Safely in South Africa

Selecting a broker is one of the most critical decisions a trader makes. A poorly chosen broker can expose traders to unnecessary risk, even if their trading strategy is sound.

Regulation and Licensing

Always confirm that a broker is properly authorized and operates under recognized regulatory oversight. Regulation enhances accountability and transparency.

Trading Platform Stability

Reliable platforms ensure accurate pricing, smooth execution, and uninterrupted access during volatile market conditions.

Cost Transparency

Spreads, commissions, rollover fees, and other charges should be clearly explained. Lack of transparency is a warning sign.

Client Fund Protection

Client funds should be segregated from company funds to reduce risk in case of financial difficulties.

Customer Support and Communication

Clear, responsive communication is essential, especially during account or technical issues.

Understanding Leverage and Its Risks

Leverage allows traders to control larger positions with smaller capital. While leverage can increase potential profits, it significantly magnifies losses.

Many traders underestimate leverage risk and overexpose their accounts. Responsible traders use leverage conservatively and focus on capital preservation.

In regulated environments, leverage limits are often imposed to protect traders from catastrophic losses.

Market Risks Every Trader Must Accept

Forex trading involves unavoidable risks that no broker or strategy can eliminate.

Price Volatility

Currencies react to economic data, political developments, and global events. Sudden price movements can occur without warning.

Liquidity Changes

Market liquidity may decrease during major news events or low-volume periods, increasing slippage risk.

Psychological Pressure

Emotions such as fear, greed, and frustration often lead to poor decision-making.

Strategy Failure

Even well-tested strategies can fail under changing market conditions.

Understanding and accepting these risks is essential for long-term participation.

Risk Management as a Core Trading Skill

Risk management is more important than entry strategies.

Effective risk management includes:

Limiting position size

Using stop-loss orders

Avoiding over-trading

Maintaining consistent risk-to-reward ratios

Protecting capital during drawdowns

Traders who prioritize risk management are more likely to survive long enough to improve their skills.

Common Instruments Traded by South African Forex Traders

South African traders often diversify beyond currency pairs.

Major Currency Pairs

These offer higher liquidity and more stable price action.

Commodities

Gold, oil, and other commodities are popular due to South Africa’s resource-based economy.

Indices

Stock indices allow traders to speculate on broader market trends.

Digital Assets

While increasingly popular, cryptocurrencies remain highly volatile and speculative.

Diversification helps reduce reliance on a single market.

The Role of Education in Trading Success

Education is the foundation of consistent trading performance.

Traders who invest time in learning:

Technical analysis

Fundamental analysis

Risk psychology

Market structure

are better prepared to adapt to changing market conditions.

Education should be continuous, as markets evolve constantly.

Legal and Financial Responsibilities of Traders

Trading forex carries legal and financial responsibilities.

Verification and Documentation

Brokers require identity verification to comply with regulations. Providing accurate information is mandatory.

Tax Awareness

Trading profits may be subject to taxation. Proper record-keeping is essential for compliance.

Cross-Border Transactions

When using international brokers, traders should understand exchange control rules and reporting obligations.

Ignoring compliance can lead to unnecessary complications.

Common Myths About Forex Trading

Forex Trading Is a Shortcut to Wealth

Sustainable success requires time, discipline, and education.

Regulation Eliminates Risk

Regulation improves safety but does not remove market risk.

More Trades Mean More Profit

Over-trading often leads to losses.

High Leverage Is Necessary

Many professional traders use low leverage consistently.

Understanding reality helps traders set realistic expectations.

Best South Africa Brokers

We compiled a comprehensive database of best South Africa Forex Brokers who are registered with the South Africa Securities and Investments Commission, and then we rated them by Overall. The best South Africa forex brokers are listed below.

Pepperstone – best South Africa Brokerage

ThinkMarkets – 3rd Best South Africa Brokerage

MultiBankGroup– 5th Best South Africa brokerage

What are the best forex brokers in South Africa in 2026?

Pepperstone stands out as one of the top choices for forex trading in South Africa due to its exceptional combination of features and services. Renowned for its transparency and reliability, Pepperstone is a regulated and reputable brokerage that offers a compelling trading experience. With its competitive spreads, lightning-fast execution speeds, and a wide range of tradable assets, Pepperstone empowers South African traders to engage in the global forex market with confidence.

Pepperstone’s user-friendly trading platforms, including the popular MetaTrader 4 and MetaTrader 5, provide advanced charting tools, technical indicators, and expert advisors, catering to traders of all skill levels. Moreover, its commitment to regulatory compliance, as overseen by reputable authorities, assures South African traders of a secure and trustworthy trading environment.

The brokerage’s emphasis on education and customer support further solidifies its position as a preferred choice. Pepperstone offers a wealth of educational resources, including webinars, tutorials, and market analysis, allowing South African traders to continually enhance their trading knowledge. Backed by responsive customer support that is available 24/5, Pepperstone ensures that traders receive timely assistance whenever needed.

In sum, Pepperstone’s combination of robust trading platforms, competitive pricing, regulatory adherence, and dedicated support makes it a standout option for forex traders in South Africa, solidifying its reputation as one of the best forex brokerages in the region.

You can read the full detail reviews of more than 10,000 words here

Available leverage

As a regulated broker, we offer retail clients up to 200:1 leverage, and professionals up to 1000:1

| Asset class | Max retail leverage | Max pro leverage |

| FX | 200:1 | 1000:1 |

| Gold | 200:1 | 1000:1 |

| Commodities (excluding gold) | 1:200 | 1:500 |

| Major indices | 1:200 | 1:400 |

| Stocks | 1:20 | 1:20 |

| BTC/USD | 1:20 | 1:400 |

AvaTrade has grown into a significant online trading platform since its inception in 2006, with about 200,000 registered clients executing up to 2 million deals each month totaling over $60 billion in trading volume. AvaTrade is regulated by the Central Bank of Ireland, ASIC, IIROC, FSA, FSB, UAE, and the British Virgin Islands, every new customer must pass a few simple compliance tests to verify that you understand the risks of trading and are permitted to trade.

AvaTrade is one of the few brokers who offers both the MetaTrader 4 and MetaTrader 5 platforms. AvaTrade allows the user to perform a 0.01 Lot trade.

Trading Features:

- Allows for scalping

- Allows for hedging

- Minimum deposit is low.

Accounts offered:

- Mini account

- Standard account

- Islamic accountDemo account

- Micro account

Funding methods:

- Skrill

- Payoneer

- PayPal

- NetellerCredit cards

- Bank Transfer

You can read full reviews about AvaTrade here

ThinkMarkets stands out as an exceptional choice for South African clients seeking a reputable and comprehensive forex brokerage. With a solid reputation in the industry, ThinkMarkets offers a range of features that make it a preferred option for South African traders.

One of the key factors that sets ThinkMarkets apart is its strong regulatory framework. The brokerage is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, ensuring that clients can trade with confidence, knowing that their interests are safeguarded and that the broker adheres to strict financial standards.

ThinkMarkets’ commitment to technological innovation is another noteworthy aspect. The broker provides access to leading trading platforms, such as MetaTrader 4 and MetaTrader 5, which empower South African traders with advanced tools for analysis, execution, and risk management. This robust technology allows clients to make informed trading decisions and execute trades seamlessly.

Furthermore, ThinkMarkets’ dedication to providing competitive trading conditions contributes to its appeal. The broker offers tight spreads, allowing traders to optimize their trading strategies and potentially enhance their profitability. Additionally, ThinkMarkets provides a variety of account types to cater to the diverse needs of South African clients, whether they are beginners or experienced traders.

ThinkMarkets’ commitment to client education and support is also evident. The broker offers educational resources, including webinars, tutorials, and market analysis, to empower South African traders with the knowledge needed to navigate the forex market effectively.

In summary, ThinkMarkets’ combination of regulatory compliance, advanced technology, competitive trading conditions, and client-centric approach makes it an excellent choice for South African traders. Its reputation for reliability and commitment to meeting the unique needs of clients further solidifies its position as a top forex brokerage in the South African market.

Trading Features:

- Offers STP

- Low min deposit

Accounts offered:

- Demo account

- Zero account

- Standard account

- Islamic account

Funding methods:

- Credit cards

- Bank Transfer

- Skrill

- Neteller

You can read the full review here

Axi, which has its headquarters in Australia and was established in 2007, has grown to become one of the most best Forex brokers in the world since then. It has done this by using some of the most renowned trading platforms in the globe. These platforms provide traders access to the most latest market data on forex, CFDs, and indices, which in turn enables them to trade at rates that are continuously competitive.

Traders have access to a wide range of products from which to pick, including contracts for difference (CFDs) based on underlying financial assets such as stock indexes, metals, foreign currencies, and commodities. Axi’s web-based trading platform is also available in a number of other languages for users’ convenience.

Axi also offers mobile trading, which ensures connection across all of the most important platforms and devices, and has servers located in New York, close to the exchange, to facilitate the execution of transactions more quickly. Additionally, it offers Expert Advisors for automated trading, as well as the choice to trade with either Standard or Pro accounts, regardless of whether the scenario is simulated or real.

- Allows hedging

- Offers STP

- Allows scalping

- Free VPS (For clients who trade 20 lots per month)

- Low minimum deposit

Accounts offered:

- Micro account

- Mini account

- Standard account

- Zero spread account

- VIP Account (Axi Elite)

- Demo account

- ECN account

- Islamic account

Funding methods:

- Bank Transfer

- Skrill

- Payoneer

- Credit cards

- Neteller

- Crypto (For clients based outside of Europe)

You can read the full review here

The MultiBank Exchange Group is a one of the best South Africa trading broker that offers services related to foreign exchange trading. Traders have access to a diverse selection of goods in a number of different marketplaces. These items include indices, shares, commodities, and currencies. It is needed that a minimum deposit of fifty dollars be made in order to open a live account, and it is regulated by ASIC, FSC, BaFin, CNMV, and FMA. On the other hand, MultiBank Group gives you access to a no-cost trial account so that you can get a feel for their system and try out different features in a risk-free environment. When compared to the average EUR/USD spread of 0.70 pips, the minimal EUR/USD spread offered by MultiBank Group, South Africa brokerage company, is considered to be typical at 0.8 pips.

At MultiBank Group, you have the opportunity to trade over 20,000 distinct products, among which are more than 55 currency pairings. One of the few South Africa forex brokers that offers both the MetaTrader 4 and MetaTrader 5 trading platforms, Multibank Group is one of such brokers. Check out our MT4 vs MT5 comparison to learn more about the differences between the two platforms. In addition to this, MultiBank Group provides access to their own technology, known as Pure ECN Pro. Traders may do business on their choice of device owing to downloadable applications available for both Mac and Windows operating systems.

You can read the full review here

South Africa Forex Brokers Comparison

Compare South Africa forex and CFDs or make a side-by-side comparison of different forex and CFDs brokers in South Africa by using either the forex broker comparison tool or the summary table that is provided below. This broker list is arranged according to the overall rating that each company has on CompareBroker.io

Comparing Trading Cost of South Africa forex brokers

Comparing Trading platform between South Africa forex brokers

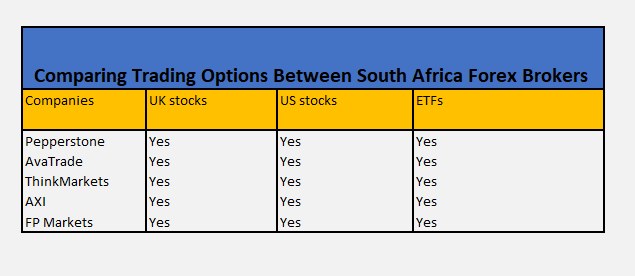

Comparing investment opportunities between South Africa forex broker

We keep a careful eye on the availability of various financial products, including but not limited to social copy trading, forex trading (both CFD and spot), stock trading (both CFD and non-CFD), spread betting, exchange-traded funds (ETFs), and more. Within our comprehensive and impartial database, these different forms of investments are monitored as variables in their own right. Investigate the types of investments that are available at the best forex brokers in South Africa.

Frequently Asked Questions

Frequently Asked Questions

Is forex trading legal in South Africa in 2026?

Yes. Forex trading is legal and regulated when conducted through authorized brokers.

Is forex trading risky?

Yes. Forex trading involves significant financial risk and is not suitable for all investors.

Can beginners trade forex?

Beginners should start with education, demo accounts, and conservative risk levels.

Are profits guaranteed?

No. Losses are a normal part of trading.

Is regulation important?

Regulation improves transparency and accountability but does not guarantee profitability.

How to trade forex for beginners

Trading forex as a beginner can be both exciting and challenging. Here’s a step-by-step guide to help you get started with forex trading:

Education and Research:

- Begin by learning the basics of forex trading. Understand key concepts such as currency pairs, pips, lots, leverage, and order types.

- Explore different trading strategies and decide which ones align with your trading goals and risk tolerance.

- Study technical analysis (chart patterns, indicators) and fundamental analysis (economic indicators, news events) to make informed trading decisions.

Choose a Reliable Broker:

- Select a reputable and regulated forex broker. Look for features like user-friendly trading platforms, competitive spreads, good customer support, and educational resources.

- Open a demo account with your chosen broker to practice trading without risking real money.

Develop a Trading Plan:

- Create a well-defined trading plan that outlines your goals, risk tolerance, preferred trading style, and strategy.

- Determine your entry and exit criteria, position sizing, risk-reward ratio, and how you’ll manage trades.

Practice on a Demo Account:

- Use the demo account to practice executing trades and implementing your trading plan.

- Gain experience and build confidence in your trading skills without risking real capital.

Understand Risk Management:

- Never risk more than you can afford to lose on a single trade.

- Use risk management tools like stop-loss orders to limit potential losses.

- Consider your risk per trade as a percentage of your total trading capital.

Start Trading with a Small Account:

- Once you’re comfortable with your demo trading, open a live trading account with a small amount of capital that you can afford to lose.

- Start with smaller position sizes to manage risk as you gain experience.

Monitor the Markets:

- Keep an eye on currency pairs that interest you. Analyze charts, identify trends, and look for potential trading opportunities.

Practice Patience and Discipline:

- Stick to your trading plan and avoid making impulsive decisions based on emotions.

- Be patient and wait for setups that align with your strategy.

Start Simple and Gradually Expand:

- Begin with a single currency pair and master your strategy before diversifying.

- As you gain experience, you can explore more currency pairs and trading strategies.

Keep Learning and Adapting:

- Forex trading is a continuous learning process. Stay updated on market developments, refine your trading strategy, and adapt to changing market conditions.

Keep Records:

- Maintain a trading journal to record your trades, reasons for entry and exit, and lessons learned. This will help you track your progress and improve over time.

Seek Knowledge and Mentorship:

- Read books, watch educational videos, and consider joining trading communities to learn from experienced traders.

- Consider seeking advice from professionals or mentors who can provide valuable insights.

How to trade forex in South Africa?

Trading forex in South Africa offers a pathway to participate in the global financial markets and potentially generate profits through currency fluctuations. As a prospective trader, the first step is to educate yourself about the forex market’s fundamentals, understanding concepts like currency pairs, pips, lots, and leverage. Next, choose a reputable and regulated forex broker that caters to South African clients.

Open a trading account with the chosen broker, providing the required documentation for verification. Many brokers offer demo accounts that allow you to practice trading with virtual funds, helping you gain confidence and refine your trading strategies without risking real money.

Develop a solid trading plan that outlines your objectives, risk tolerance, and preferred trading style. Utilize both technical and fundamental analysis to make informed trading decisions, studying price charts, patterns, indicators, and staying informed about economic news and events that impact currency markets.

Risk management is crucial; never invest more than you can afford to lose on a single trade. Utilize risk management tools like stop-loss and take-profit orders to protect your capital. As you gain experience, gradually increase your position sizes while maintaining prudent risk management practices.

Monitor the forex market closely, execute trades based on your analysis, and adapt your strategies as needed. Stay disciplined, avoid emotional trading, and keep learning and refining your skills over time.

Lastly, be aware of the legal and tax implications of forex trading in South Africa. Consult with financial professionals to ensure compliance with local regulations and to manage your tax obligations. With dedication, education, and a well-defined approach, forex trading in South Africa can offer opportunities for both financial growth and personal development.

How to trade forex with leverage

Trading forex with leverage allows traders to control a larger position size with a relatively smaller amount of capital. Leverage amplifies both potential profits and losses, making it a powerful tool that requires careful consideration and risk management. To trade forex with leverage, a trader first selects a leverage ratio offered by their broker, such as 10:1 or 50:1. For example, with a 50:1 leverage, a trader can control a $50,000 position with just $1,000 of their own capital.

While leverage can enhance gains, it also increases exposure to market fluctuations. Therefore, traders must implement effective risk management strategies, including setting stop-loss and take-profit orders, to limit potential losses. It’s crucial to thoroughly understand the risks associated with leverage and only use it if you have a solid trading plan and the necessary knowledge. As a responsible practice, traders should never risk more than they can afford to lose and should be aware that using high leverage can magnify both profits and losses, requiring a cautious and disciplined approach to trading.

How to trade forex with ai

Trading forex with artificial intelligence (AI) involves using advanced algorithms and technology to make trading decisions. Here’s a general overview of how to trade forex using AI:

Understand AI in Forex Trading:

- Familiarize yourself with the concept of using AI in trading. AI can analyze vast amounts of data, recognize patterns, and make predictions based on historical and real-time market information.

Choose an AI Trading Platform:

- Research and select a reputable AI-powered trading platform or software. These platforms often offer automated trading strategies, signal generation, and other AI-based tools.

Data Collection and Analysis:

- AI systems require historical and real-time market data. Ensure your chosen platform has access to accurate and timely data feeds.

Algorithm Development:

- Depending on the platform, you may need to develop or customize trading algorithms. This could involve coding or configuring the AI to follow specific strategies.

Backtesting:

- Test the AI algorithm using historical data to assess its performance and effectiveness. This helps you understand how the AI would have performed in past market conditions.

Risk Management:

- Implement robust risk management parameters within the AI system. This may include setting stop-loss and take-profit levels, as well as controlling position sizes.

Real-Time Monitoring:

- Once the AI system is live, monitor its performance in real-time. Be prepared to intervene if necessary or adjust settings based on changing market conditions.

Adaptation and Optimization:

- Continuously analyze the AI’s performance and refine the algorithm as needed. Market dynamics can change, requiring adjustments to maintain effectiveness.

Diversification:

- Consider using multiple AI algorithms or strategies to diversify your trading approach and reduce risk.

Understand Limitations:

- While AI can analyze data and patterns, it may not be foolproof. It’s essential to understand that AI systems can also encounter errors and unexpected market movements.

Education and Learning:

- Even if you’re using AI, it’s crucial to understand forex market dynamics and trading principles. This knowledge helps you interpret AI-generated signals and make informed decisions.

Demo Testing:

- Before trading with real money, test the AI system on a demo account to ensure it performs as expected in a live market environment

How to trade forex news

Trading forex news involves capitalizing on significant market movements triggered by the release of economic indicators, geopolitical events, and other news releases. To effectively trade forex news, traders must stay well-informed about upcoming events through economic calendars and news sources. The key lies in anticipating market reactions based on the divergence between the actual data and market expectations. Rapid execution of trades immediately after the news release is crucial, as volatility can lead to swift price movements. It’s essential to employ risk management tools like stop-loss orders to mitigate potential losses, given the unpredictable nature of news-driven market movements. Trading forex news demands a deep understanding of market dynamics, swift decision-making, and the ability to interpret and analyze data in real-time, making it a strategy favored by experienced traders.

Can I do forex trading in South Africa?

Yes, you can engage in forex trading in South Africa. The country has a vibrant and growing forex trading community, and many South Africans participate in the global currency markets. To get started, you’ll need to choose a reputable and regulated forex broker that offers its services to South African residents. Once you’ve selected a broker and opened a trading account, you can begin to trade a variety of currency pairs and potentially profit from the fluctuations in exchange rates. However, it’s important to educate yourself about the forex market, develop a solid trading plan, and practice disciplined risk management to enhance your chances of success. Keep in mind the legal and tax considerations associated with forex trading in South Africa, and consider seeking guidance from financial professionals to ensure compliance with local regulations. With the right approach and dedication to learning, forex trading can be a viable and rewarding endeavor in South Africa.

Can I trade with forex with $100

Yes, you can start trading forex with as little as $100. Many brokers offer micro or mini accounts that allow you to trade with a small initial deposit. These accounts provide an opportunity for beginners to get a feel for real trading while managing their risk. With a $100 investment, you can take advantage of leverage provided by your broker, which allows you to control a larger position size than your initial capital.

However, it’s important to approach trading with caution and a realistic mindset. While starting with a small amount is possible, trading with a limited capital requires careful risk management and a focus on preserving your funds. You should be prepared for the potential of both gains and losses, and it’s advisable to start with smaller position sizes and gradually increase as you gain experience and confidence.

Remember that successful forex trading involves continuous learning, practice, and discipline. It’s recommended to first practice on a demo account to familiarize yourself with the platform and your trading strategy before transitioning to live trading with real money.

Is forex trading safe?

Forex trading, like any form of investment, carries inherent risks and requires careful consideration. While forex trading offers potential for profit, it also involves the possibility of substantial losses. The degree of safety in forex trading depends on factors such as one’s knowledge, experience, risk management strategies, and the reliability of the chosen forex broker. Using regulated and reputable brokers can enhance the safety of your trading experience by ensuring fair practices, secure transactions, and adherence to regulatory standards. Moreover, traders who diligently educate themselves, practice on demo accounts, develop sound trading plans, and exercise disciplined risk management can mitigate risks and create a safer trading environment. It’s crucial for traders to understand that success in forex trading requires continuous learning, careful analysis, and a realistic understanding of both profit potential and potential losses.

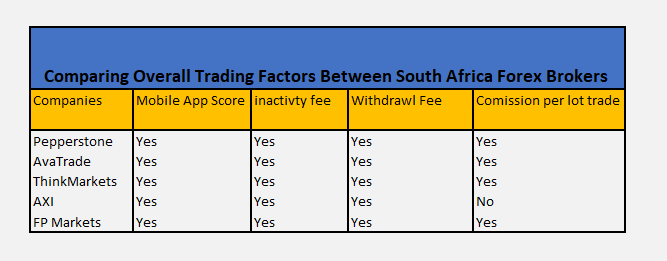

Best South Africa Forex Brokers

The best forex brokers in South Africa charge a variety of commissions, which we have outlined in the table below.

Final Thoughts

Forex trading in South Africa in 2026 offers opportunity, but only for traders who approach the market responsibly. A strong regulatory environment, advanced trading platforms, and access to global markets make South Africa one of the more structured forex trading destinations in Africa.

However, success in forex trading depends far more on education, discipline, and risk management than on broker selection alone. Traders who focus on long-term learning, realistic expectations, and capital protection are better positioned to navigate the complexities of the forex market.

Forex trading should be treated as a professional financial activity, not a gamble or shortcut to wealth. With the right mindset and preparation, South African traders can participate responsibly while protecting their financial future.