Forex.com and Axi are two well-known brokers in the forex and CFD space, each with a loyal global user base and strong regulatory credentials. While Forex.com is a global heavyweight under a publicly traded parent company, Axi (formerly AxiTrader) markets itself as a trader-built broker with lean pricing and transparency.

This 2025 comparison helps you understand the strengths and weaknesses of both platforms across areas like fees, regulation, trading platforms, leverage, and educational tools.

Broker Review Contents

Broker Overview

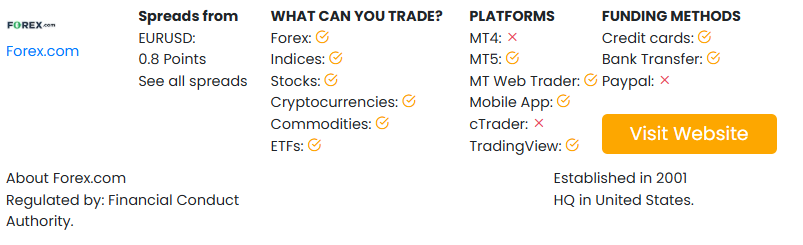

Forex.com is a globally recognized broker owned by StoneX Group (NASDAQ: SNEX), serving traders in over 180 countries.

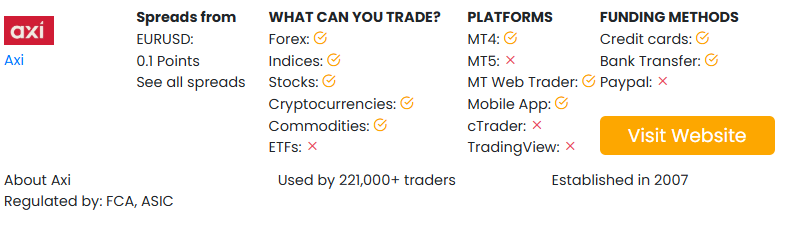

Axi, based in Australia, has expanded steadily since 2007 with a focus on providing competitive spreads and a trader-first approach.

| Feature | Forex.com | Axi |

|---|---|---|

| Founded | 2001 | 2007 |

| Headquarters | USA | Sydney, Australia |

| Regulation | CFTC, FCA, ASIC, IIROC, CySEC | ASIC, FCA, DFSA, FMA |

| Parent Company | StoneX Group (Public) | Independent |

| Clients Served | 300,000+ globally | 60,000+ globally |

Regulation and Safety

Forex.com is regulated in five major jurisdictions:

- CFTC/NFA (USA)

- FCA (UK)

- ASIC (Australia)

- IIROC (Canada)

- CySEC (Europe)

Axi is regulated in:

- ASIC (Australia)

- FCA (UK)

- DFSA (Dubai)

- FMA (New Zealand)

Both brokers are well-regulated, but Forex.com has deeper reach in North America and offers U.S. traders access to forex markets—something Axi does not provide.

Trading Platforms

Forex.com offers:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

- Advanced Trading Platform

- TradingView integration

- WebTrader and mobile apps

Axi provides:

- MetaTrader 4 only

- MT4 NexGen plugin for advanced tools

- Mobile and web access

Forex.com provides broader platform variety and deeper integration with analytical tools. Axi focuses exclusively on enhancing MT4 with plugins and extensions for experienced users.

Available Markets

| Asset Type | Forex.com | Axi |

|---|---|---|

| Forex Pairs | 80+ | 70+ |

| Indices | Yes | Yes |

| Commodities | Yes | Yes |

| Cryptocurrencies | Yes | Yes |

| Stocks (CFDs) | Yes | No |

| ETFs | Yes (CFDs) | No |

| Futures | No | No |

| Precious Metals | Yes | Yes |

Forex.com offers more asset types including stocks and ETFs, while Axi sticks to core offerings like forex, metals, and crypto.

Account Types

Forex.com:

- Standard

- Commission (RAW spreads)

- DMA (Direct Market Access)

- Swap-free (Islamic)

Axi:

- Standard

- Pro Account (RAW spreads)

- Elite Account (for high volume traders)

- Swap-free available

Both brokers cater to various trader profiles, but Forex.com includes DMA for institutional-style access, while Axi tailors options more toward advanced MT4 users and professionals.

Spreads and Commissions

Forex.com:

- Standard account: From 1.0 pip

- Commission account: From 0.2 pip + $5/lot

- No deposit fees, inactivity fee applies after 12 months

Axi:

- Standard account: From 1.0 pip

- Pro account: From 0.0 pip + $7/lot

- Elite account: Custom commissions (high volume)

- No deposit/withdrawal fees

Axi offers lower commission rates on its Pro account but lacks variety in pricing models compared to Forex.com’s flexibility.

Leverage and Margin

| Region | Forex.com | Axi |

|---|---|---|

| UK/EU Retail | 1:30 | 1:30 |

| U.S. Traders | 1:50 | Not accepted |

| Global (Pro) | Up to 1:200 | Up to 1:500 |

Axi provides higher leverage for professional and global clients, especially outside ESMA zones. Forex.com has more regulatory restrictions but offers safer caps for newer traders.

Education and Trading Tools

Forex.com:

- Trading Central

- Autochartist

- Webinars and market outlooks

- Strategy optimizer

- Integrated TradingView charts

Axi:

- MT4 NexGen toolkit

- PsyQuation analytics (for pro accounts)

- Daily market commentary

- Webinars and ebooks

Forex.com delivers better variety with third-party analytics and beginner-friendly tools. Axi focuses on boosting MT4’s core with unique plugins like PsyQuation.

Mobile Trading

Forex.com:

- All-in-one mobile trading app

- Custom charting and risk management tools

- Real-time news and alerts

Axi:

- MT4 mobile app

- Simple, clean layout

- Fast execution

Forex.com’s proprietary mobile app provides more functionality, while Axi keeps things straightforward through the MT4 app interface.

Customer Support

Forex.com:

- 24/5 support

- Phone, chat, and email

- Localized service in major regions

Axi:

- 24/5 multilingual support

- Live chat and email

- Account managers for higher-tier clients

Both brokers offer solid customer service, but Axi puts extra focus on support for higher-tier clients, while Forex.com ensures broad accessibility across time zones.

Comparison Summary Table

| Feature | Forex.com | Axi |

|---|---|---|

| Regulation | US, UK, CA, AU, EU | UK, AU, NZ, UAE |

| Minimum Deposit | $100 | $0 (Standard), $500 (Pro) |

| Platforms | MT4, MT5, Web, TradingView | MT4 + NexGen |

| Spreads | From 0.2 pip (Commission) | From 0.0 pip (Pro) |

| Leverage | Up to 1:200 | Up to 1:500 |

| Stocks and ETFs | Yes | No |

| Mobile Trading | Advanced proprietary app | MT4 mobile only |

| Tools and Analytics | Autochartist, Trading Central | PsyQuation, MT4 NexGen |

| Ideal For | Global multi-asset traders | Pro forex traders using MT4 |

Forex.com stands out as a globally regulated, multi-platform broker for traders who want access to multiple asset classes, deep analytics, and professional tools. It’s a top choice for traders in the U.S., Canada, EU, and Asia looking for balanced trading options.

Axi, on the other hand, appeals to more advanced forex traders who prefer raw spreads, powerful MT4 upgrades, and higher leverage. Its no-frills approach is especially attractive to scalpers, day traders, and users seeking transparency in execution.