The enormous collectibles market that eBay (EBAY 6.26 percent) runs is moving online. To further its goals of trading digital assets, the e-commerce giant purchased KnownOrigin, a non-fungible coin (NFT) platform.

NFTs employ blockchain technology to establish possession of the goods like works of art, music, films, and books and to avoid duplication. Owners of NFTs may profit from the special nature of their asset while also receiving royalties and other perks. Due to this, investors and collectors alike adore the assets.

According to data source Nonfungible.com, sales of NFTs increased 21,500% to over $17.5 billion in 2021. There are even larger estimations of the magnitude of the NFT market. NFT sales for the previous year were estimated at around $24.5 billion by market watcher DappRadar. Millions of dollars have been paid for individual NFTs, with one going for an astounding $68 million thanks to a deal arranged by renowned auction house Christie’s.

Sports Influences on NFTs

Sports enthusiasts are especially fond of NFTs. Basketball-specific NFT platform NBA Top Shot had sales of $1.2 billion or more in May. The Football League (NFL) and Major League Baseball (MLB), two other major sports organizations, have also introduced NFT offers for its fans.

The agreement should support eBay’s activities geared toward collectibles. In June, the business introduced a vaults services to safeguard the tangible belongings of its clients, including priceless sports cards. Due to the epidemic, the value of many trading cards has increased, and collectors and investors are more in need of services like discovery, classification, preservation, and trading.

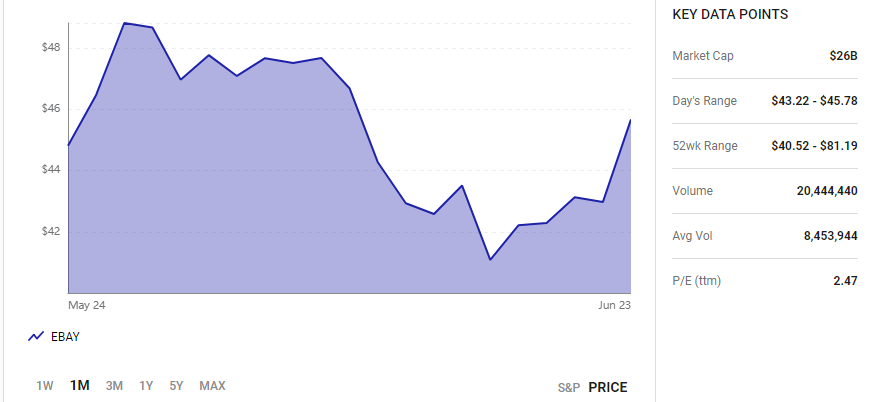

So, is it wise to acquire eBay stock?

eBay is not a wise investment just because you bought KnownOrigin. It is true that NFT payments could increase platform sales on eBay. It should be noted, nonetheless, that in 2022, the NFT industry’s slow its progression significantly.

Additionally, during the last several quarters, eBay has lost customers. Many people are cutting down on discretionary expenditure as a result of inflation. Furthermore, there isn’t the same level of interest in collecting as there was in the beginning phases of the epidemic, when stimulus payments and days off from work provided individuals with the resources and chance to grow their collections.