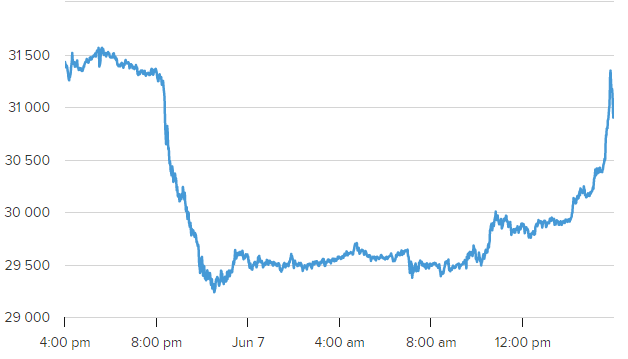

As the cryptocurrency’s current sell-off began, Bitcoin fell on Tuesday, going below the critical point of $30,000 at one point. According to CompareBroker analysis, the bitcoin price was recently down by less than 1% at $32,150. It had plummeted as low as $29,500 previously in the day, after rising more than 4.2 percent the previous campaign to trading around $31,500.

Ether recovered some of its recent losses and was selling at around $1,860 on Tuesday, down less than 1%. It has previously fallen to as little as $1,730. The steps came after news that the financial services Authority is looking into whether Binance’s BNB token, a cryptocurrencies, might be classified as a commodity. The business sell-off was headed by BNB. It is now down by 7%.

Bitcoin Drops Below 30,000 Mark

From the all high of $68,500 in November, Bitcoin has dropped more than half of that amount. After the Terra crash, the digital token had lost eight weeks in a row and had fallen below $30,500 last month. Cryptocurrencies have already been trading in lockstep with stocks, which have had a difficult year due to concerns about increasing interest rates, inflationary pressures, and the possibility of a slowdown or outright catastrophe. In 2022, the S&P 500 has down more than 13.5 percent, while the innovation Nasdaq Composite has dropped 23.3 percent. According to Bernstein researcher Gautam Chhugani, BTC’s growing connection with stock, stagnant transaction growth, and the development of ETH as a store of wealth competitor might diminish BTC’s supremacy.

Wall Street Perspective of Bitcoin

Nonetheless, some of those on Wall Street believe Bitcoin will recover. After the recent washout, JPMorgan’s Nikolaos Panigirtzoglou predicted that the cryptocurrency will rise by 32.3 percent. The carefully regarded consumer price index report, which is coming out Friday, will be another challenge for Bitcoin this week. If the May estimate is lower than April’s, as projected, some may view it as a signal that prices has reached its peak.

According to Yuya Hasegawa, a crypto currency market researcher at Japanese cryptocurrency exchange Bitbank. Hasegawa said it’s still unclear how much a Fed rate rise of 50 basis points in May would lower prices. As a result, it will be tough to fill new posts until the CPI is released on Friday. Bitcoin may continue to trade flat till then, however the marketplace should be prepared for the consequences.